It is normal practice for the new rates for travel allowances for the ensuing year to be tabled in the Budget speech in February. For some odd reason the last two years SARS has only made this information available post-budget.

Determination of rate per kilometre

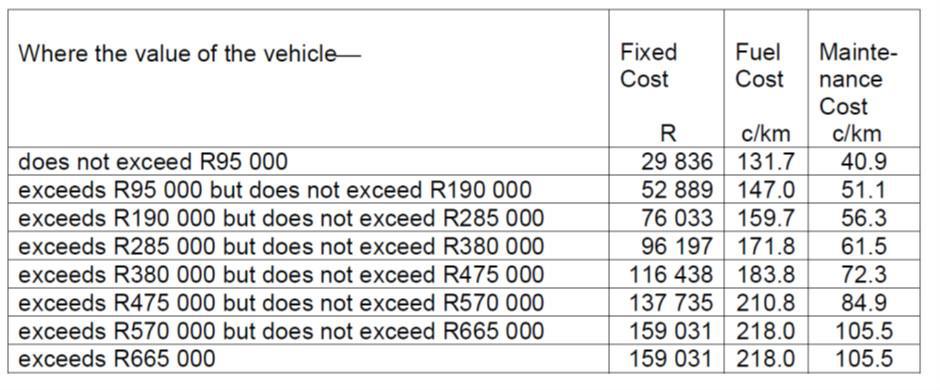

The rate per kilometre is determined in accordance with the cost scale set out below, and must be the sum of—

(a) the fixed cost divided by the total distance in kilometres (for both private and business purposes) shown to have been travelled in the vehicle during the year of assessment: Provided that where the vehicle has been used for business purposes during a period in that year which is less than the full period of that year, the fixed cost must be an amount which bears to the fixed cost the same ratio as the period of use for business purposes bears to 365 days;

(b) where the recipient of the allowance has borne the full cost of the fuel used in the vehicle, the fuel cost; and

(c) where that recipient has borne the full cost of maintaining the vehicle (including the cost of repairs, servicing, lubrication and tyres), the maintenance cost.

Simplified method

Where—

(a) the provisions of section 8(1)(b)(iii) are applicable in respect of the recipient of an allowance or advance; and

(b) no other compensation in the form of a further allowance or reimbursement (other than for parking or toll fees) is payable by the employer to that recipient, that rate per kilometre is, at the option of the recipient, equal to 418 cents per kilometre.

Effective date

The rate per kilometre determined in terms of this Schedule applies in respect of years of assessment commencing on or after 1 March 2022. Should you have any queries in this regard please do not hesitate to contact us.

© 2020 Nexia SAB&T. ALL Rights Reserved. Nexia SAB&T is a member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the “Member firm disclaimer” for further details.