When companies enter into certain funding arrangements, these arrangements may at times be described as loans while actually possessing the characteristics of equity.

A fundamental principle of IFRS requires entities to apply the consideration of “substance over form” when applying IFRS. This is of particular importance when analysing intercompany transactions. Care should be taken when assessing whether items described as loans by the entity meet the definition of a liability in terms of IAS 32.

Clarity should be obtained from the entity where the terms of the arrangement are not clearly defined.

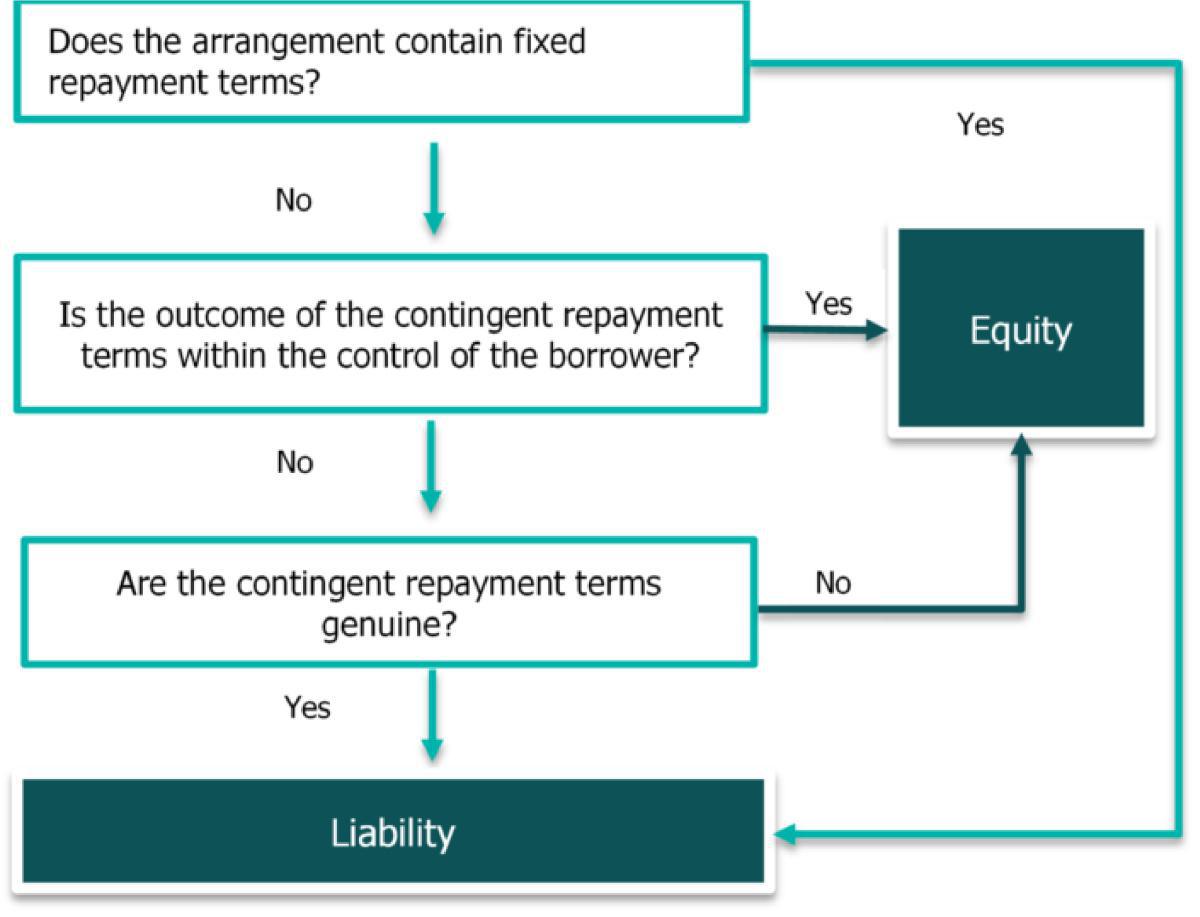

Once the terms are defined, an analysis should be performed to determine whether any repayment terms exist, as well as the nature of those repayment terms. To the extent that the arrangement does not contain any repayment terms, i.e. the amount is not repayable by the issuer, the instrument should be classified as an equity instrument.

Certain arrangements may contain repayment terms which could result in the classification of the arrangement as an equity instrument, rather than a liability. These are often more difficult to assess. The key feature of such an arrangement would be that it provides the issuer (borrower) with an unconditional right to avoid repayment.

Examples of terms which may result in the classification as EQUITY are:

- Repayable at the discretion of the board of directors of the borrower

- Repayable at the discretion of the borrower

- Repayable in the first year after the entity issues dividends

- Repayable in the event of the entity listing on a stock exchange

In all the examples above, the borrower has control over the occurrence or non-occurrence of the situations in respect of repayment. This provides the borrower with the ability to avoid repayment indefinitely. This would therefore likely lead to the classification of the arrangement as an equity instrument.

Examples of terms which may result in the classification as LIABILITY are:

- Repayable at a predetermined level of profits

- Repayable at a fixed date in the future

- Repayable at the option of the lender

- Mandatory dividend payments

In the examples above, although in certain instances the repayment date is not fixed, i.e. is contingent on future outcomes, these outcomes are not within the control of the borrower. Therefore, the borrower does not have the unconditional right to avoid repayment in the event that these situations occur. This would result in the classification of the arrangement as a liability.

An additional consideration in this assessment would be whether the terms examined are genuine. If it is determined that the terms which would require repayment (resulting in liability classification) are not genuine (there is no real intention to comply with the terms of the agreement) then the agreement would be classified as an equity instrument. This is only expected to be the case in rare circumstances.

Decision tree:

© 2020 Nexia SAB&T. ALL Rights Reserved. Nexia SAB&T is a member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the “Member firm disclaimer” for further details.