Cash comprises cash on hand and demand deposits.

IAS 7 is the standard which provides guidance on the preparation of the Statement of Cash Flows. This standard also provides us with the definitions of cash and cash equivalents. These definitions should guide preparers when presenting items as cash and cash equivalents on the Statement of Financial Position.

Cash equivalents short -term, highly liquid investments that are readily convertible to highly amounts of cash and which are subject to an insignificant risk of changes in value.

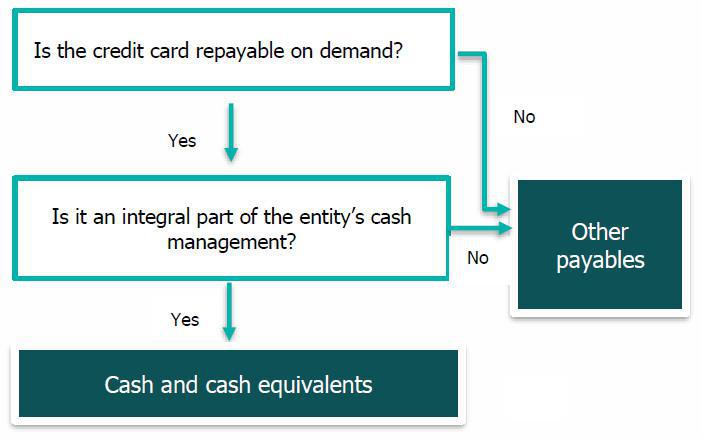

Short-term financing arrangements such as credit cards may carry different terms and possess different characteristics. In addition, the purpose for which these are held may differ between entities. Certain entities classify these as cash and cash equivalents while other entities classify these as trade creditors.

A request for guidance on the classification of bank borrowings as cash and cash equivalents has previously been submitted to the IFRIC. During their deliberations, the IFRIC noted that bank borrowings were generally classified as financing activities, except in limited circumstances. These limited circumstances relate to overdrafts which are used as an integral part of an entities cash management. For these overdrafts to qualify as cash and cash equivalents they should possess the following two characteristics:

- They should be repayable on demand; and

- They should form an integral part of an entity’s cash management

There is no rule that states that all credit card arrangements should be classified as either “trade” or “other” payables or “cash and cash equivalents”. Each arrangement will need to be assessed separately to determine the correct classification. In our view, classification as “trade” payables may not reflect the nature of these accurately as the bank is usually not a provider of goods, i.e., not a supplier.

Characteristics of cash

- Repayable on demand

- Integral part of an entity’s cash management

A good indicator on whether the arrangement forms an integral part of the cash management activities of an entity is when the balance on the credit card fluctuates between positive and negative. Another consideration should be the definition that the entity applies when defining cash and cash equivalents in accordance with IAS 7.

Bank borrowings that do not meet the characteristics of cash and cash equivalents are classified as financing activities for purposes of the cash flow statement, and hence, presentation as “other payables” would be more appropriate.

Careful assessment of the terms of each specific credit card arrangement should be made to ensure that it accurately reflects the nature of the instrument.

Decision tree:

© 2020 Nexia SAB&T. ALL Rights Reserved. Nexia SAB&T is a member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the “Member firm disclaimer” for further details.