The reserve bank has published an overview of the current and historical rates for various taxes, duties and levies collected by the South African Revenue Service (SARS). For the most important types of taxes, the coverage dates back to 1979, but for the less important ones, only a more recent subset is covered. It makes for interesting reading so we have summarised some of the key taxes over the years. The full publication is available here.

Persons and individuals

Marginal tax rates applicable to the top income group

Top income earners have been taxed as low as as 40% (2002/03 to 2014/15) and as high as 60% (1971 to 1978/79)

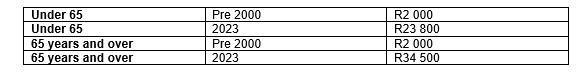

Interest and dividend income exemption

Corporations and other enterprises

Companies tax was at 50 % in the 1980’s and has since the 1990 ‘s progressively reduced to 27% in 2024.

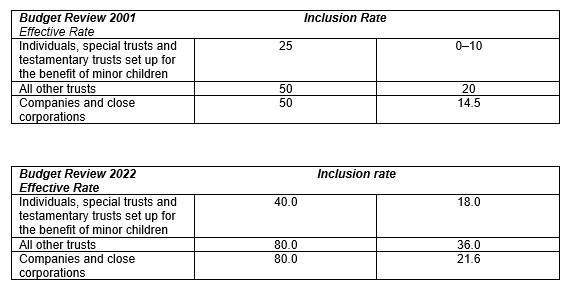

Capital gains tax

© 2020 Nexia SAB&T. ALL Rights Reserved. Nexia SAB&T is a member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the “Member firm disclaimer” for further details.