Entities in a group often provide financing to each other. This financing could be at market-terms or at non-market terms. In this month’s tip we will discuss those loans with a low credit risk at the reporting date. A loan is determined to have low credit risk if:

- the financial instrument has a low risk of default;

- the borrower has a strong capacity to meet its contractual cash flow obligations in the near term; and

- adverse changes in economic and business conditions in the longer term may, but will not necessarily, reduce the ability of the borrower to fulfil its contractual cash flow obligations (IFRS 9.B5.22).

When determining if a financial instrument is considered to have low credit risk, collateral held is not taken into account. Therefore, a financial instrument is not determined to have low credit risk due to the entity holding high levels of collateral over the loan.

IFRS 9 contains an important simplification that, if a financial instrument has low credit risk, then an entity is allowed to assume at the reporting date that no significant increases in credit risk have occurred. For low risk instruments, the entity would recognise an allowance based on 12-month ECLs.

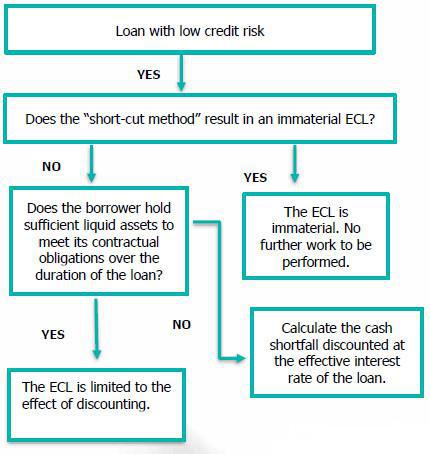

A short-cut method may be applied when determining the ECL for these loans. The entity may assume the probability of default (PD) is equal to that of an investment grade loan. This would then be applied to a loss given default (LGD) of 100%. In other words, it is assumed that in the event of default, the entity would not recover any amount from the debtor (worst case scenario). If it is determined that the calculated amount is immaterial, no additional work is required.

However, if the result of the above calculation is deemed material, additional work is required. It is unlikely that the entity would be unable to recover anything at all in the event of default, moreso with a financial instrument which is deemed to have low credit risk. Therefore a detailed calculation would now be required.

- An assessment of the borrower’s ability to repay the loan over the remaining period of the loan should be performed. This requires an assessment of the availability of accessible liquid assets to settle the amount outstanding.

- To the extent that adequate accessible liquid assets are expected to be available to settle the amount outstanding throughout the loan duration, no further work is required.

- In the event that the borrower does not hold sufficient liquid assets to settle the amount outstanding, the entity should consider whether any of the strategies which may be employed to collect contractual cash flows would result in a recovery of the entire amount outstanding. If so, the ECL is limited to the effect of time value of money.

- If the entity determines that it is not likely that the entire amount outstanding will be recovered through the use of recovery strategies, the cash shortfall is discounted using the effective interest rate of the loan.

In all instances above, when the entity determines the accessible liquid assets available to settle the intercompany loan, any other debt which would need to be repaid prior to the repayment of the intercompany loan, should be deducted from the balance.

Overall, the intention of the ECL model contained within IFRS 9 is to ensure that impairment losses are recognized prior to the incurrence of losses. This is achieved through the assessment of forward-looking information. Methods used to achieve this objective may differ, but should result in a situation where this objective is achieved.

Decision tree:

© 2020 Nexia SAB&T. ALL Rights Reserved. Nexia SAB&T is a member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the “Member firm disclaimer” for further details.