What is an investment entity?

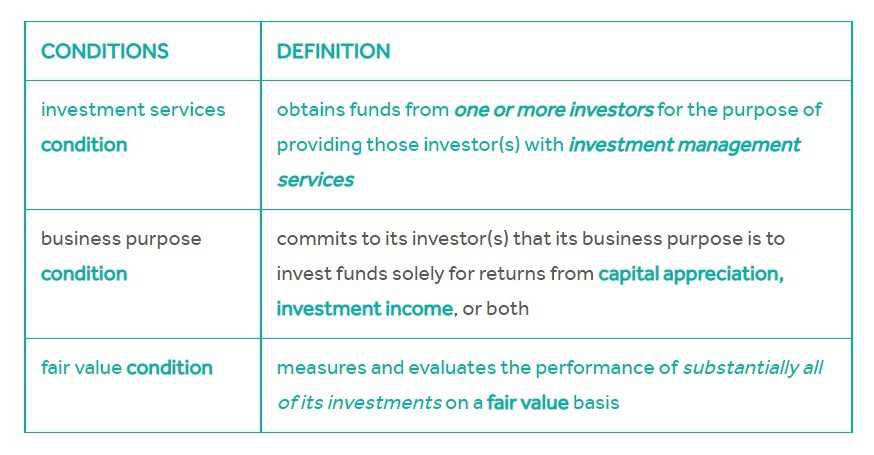

Generally, all parents must prepare consolidated information in their general-purpose financial statements as this provides investors with a full understanding of the financial position and performance of the group. However, IFRS 10 provides for an exemption to investment entities. The definition of an investment entity [IFRS 10.27] is fundamental when determining if the exception should be applied. It has three components, accompanied by four ‘typical characteristics’ [IFRS 10.28]. Establishing whether an entity meets the definition of an investment entity is the central element to this exception and could require significant judgement.

In assessing whether it meets the definition, an entity shall consider whether it has the following typical characteristics of an investment entity:

- it has more than one investment

- it has more than one investor

- it has investors that are not related parties of the entity (or its investees)

- it has ownership interests in the form of equity or similar interests.

Although this is not a rule, it is generally expected that all four characteristics should be met before the entity would be considered an investment entity. Examples of entities that typically would be considered investment entities are unit trusts, pension funds, venture capitalists, investment funds and private equity organisations. Typically, these investments are also characterised by some exit strategy as the investors does not plan to invest in these entities indefinitely. The investment plan should provide evidence of such.

Applying the definition to the ultimate parent

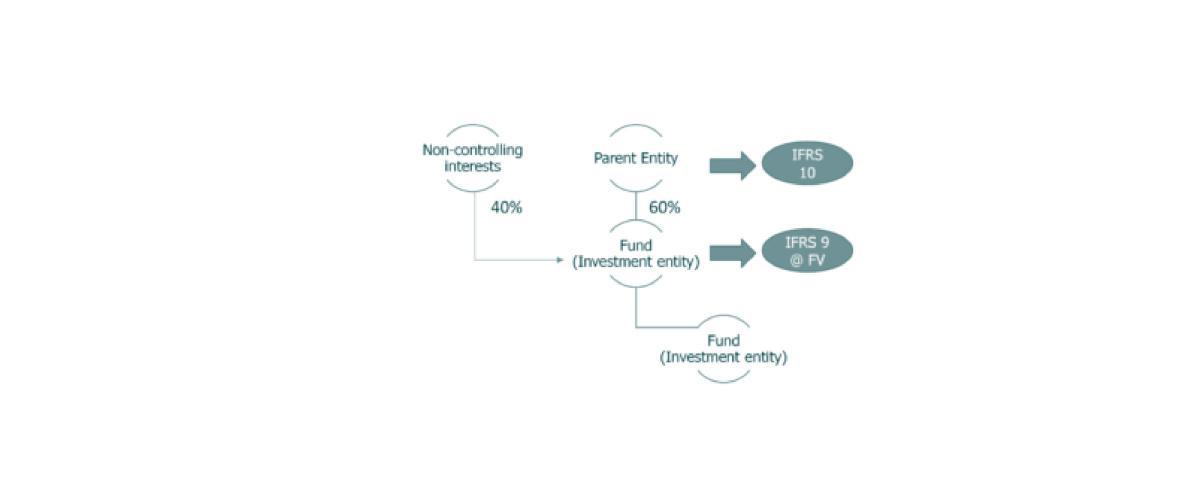

If an entity in a group meets the definition of an investment entity but the definition is not met by the parent, the parent is still required to prepare consolidated financial statements.

Subsidiaries providing investment-related services

If a subsidiary of an investment entity provides investment related services, the investment entity is still required to consolidate that entity.

Associates and Joint Ventures (JV’s)

Venture capital organisations, mutual funds, unit trusts and similar entities may elect to measure their investments in associates and JVs at fair value [IAS 28.18]. The selection is done on an investment-by-investment basis. Other entities have an accounting policy choice to account for their interest in an associate or JV that are an investment entity or apply the equity method in their consolidated financial statements [IAS 28.36A].

© 2020 Nexia SAB&T. ALL Rights Reserved. Nexia SAB&T is a member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the “Member firm disclaimer” for further details.