The Minister of Finance delivered his budget speech on 24 February 2021. Due to Covid pandemic, tax relief were provided mainly for individual tax to assist in the recovery of the economy.

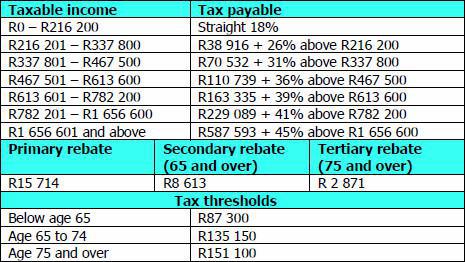

The individual tax brackets were increased with the lowest tax rate of 18% applicable to income of R216 200 and the maximum marginal rate at 45% applicable to income above R1 656 601.

Individual Tax

- Interest exemption

- 65 years and under = R23 800

- 65 years and older = R34 500

- Medical tax credits

- R3 984 per person for the first 2 members

- R2 688 per person for each additional member

New tax tables and rebates

Companies and Trusts

- Tax rate for companies to be lowered from 28% to 27% from April 2022

- Tax rate for trusts is at 45%

Transfer duty

- Transfer duty remains unchanged

Donations Tax

Remains unchanged-

- Exempt up to R100 000 per annum

- Donations tax payable at 20% on a donation not exceeding R30 million and 25% where it exceeds R30 million by donor

Capital Gains Tax

CGT inclusion rates remain unchanged:

- For individuals and special trusts 40%

- Companies 80%

Value added Tax

Tax rate remains unchanged at 15%.

- Other trusts 80%

Exclusions for individuals remain unchanged:

- Annual exclusion = R40 000

- Exclusion on death = R300 000

- Primary residence = R2 million

- Small business exclusion (assets up to R10 million) = R1.8 million

Dividend Tax

- Tax rate remains unchanged at 20%.

Retirement Funds

- Contributions are deductible – limited to the greater of 27.5% of taxable income or remuneration and the lower of R350 000 or 27.5% of taxable income before taxable capital gain.

Other increases

- Fuel increase by 15 cents per litre (from 7 April 2021)

- RAF levy increase by 11 cents per litre (from 7 April 2021)

- UIF contribution ceiling increase to R17 711.58 per month (from 1 March 2021)

- Plastic bag levy reduced to 12.5 cents per bag for bio-based plastic bags (date to be announced)

- 8% increase in specific excise duties on tobacco products and alcoholic beverages

Venture Capital Company tax incentive

- No extension of the venture capital company tax incentive after 30 June 2021.

SARS interest rate

© 2020 Nexia SAB&T. ALL Rights Reserved. Nexia SAB&T is a member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the “Member firm disclaimer” for further details.