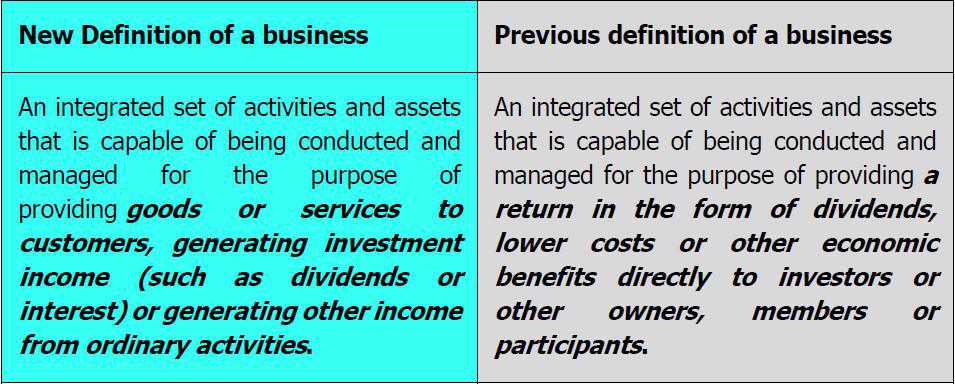

Amendments were made to the definition of a ‘business’, with the aim of helping entities to determine whether a transaction should be accounted for as an asset acquisition or a business combination in terms of IFRS 3.

The changes narrow the definition by:

- focusing on providing goods and services to customers

- removing the emphasis from providing a return to shareholders

- removing the reference to ‘lower costs or other economics benefits’

At initial recognition, when an enity gains control over a business or acquires a business, an entity needs to consider whether IFRS 3 is applicable to the transaction.

Goodwill is ONLY recognised when the new definition of a business is met AND the purchase price for the business is more in consideration of the fair value thereof as measured in accordance with IFRS 3.

The effect of this amendment is that far less “business combinations” will be recognised and therefore far less recognition of “goodwill”.

Where an entity concludes that it is not acquiring a business, the individual assets and liabilities acquired are recognised at acquisition.

In summary, the following changes were made:

- clarify the minimum attributes that the acquired set of activities and assets must have to be considered a business

- remove the assessment of whether market participants are able to replace missing inputs or processes and continue to produce outputs

- narrow the definition of a business and the definition of outputs

- add an optional concentration test that allows a simplified assessment to determine that an acquired set of activities and assets is not a business

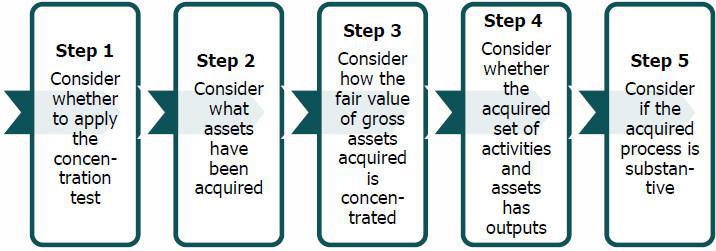

Five steps in determining whether an acquisition is a business combination:

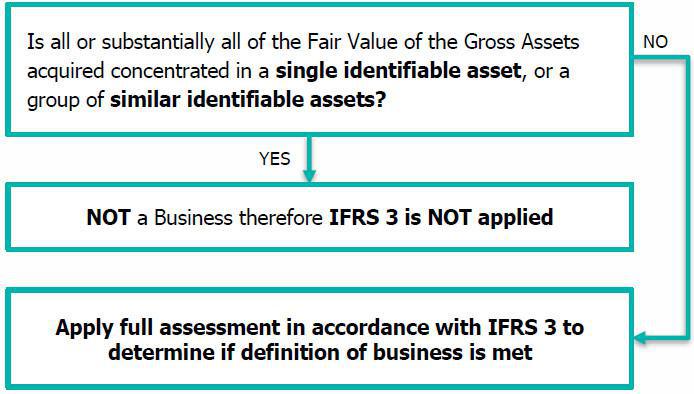

The optional concentration test is not an accounting policy or a professional judgement but it can assist entities to determine whether an integrated set of activities acquired is NOT meeting the definition of a business and is therefore outside the scope of IFRS 3.

As this is optional, an entity can decide to use it for one type of acquisition and ignore it for the next. If applied, when the concentration test is POSITIVE, then the acquisition is NOT a business combination.

Concentration test criteria:

© 2020 Nexia SAB&T. ALL Rights Reserved. Nexia SAB&T is a member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the “Member firm disclaimer” for further details.