As intercompany loans are eliminated on consolidation for subsidiaries, no financial assets or liabilities related to intercompany loans are recorded in the consolidated financial statements. This negates the requirement to consider impairment of these financial assets in respect of consolidated financial statements. However, the implications of impairment on intercompany loans should still be considered when separate financial statements are prepared.

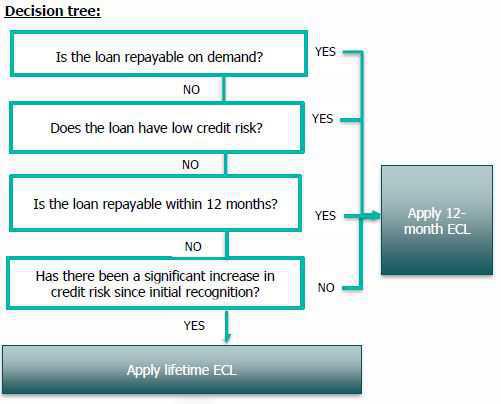

The terms of the loans will determine the approach to be followed in assessing the expected credit loss, as discussed below.

The following types of intercompany loans will be discussed briefly:

- Loans repayable on demand

- Loans due within 12 months

- Loans with low credit risk

- Loans which display a significant increase in credit risk since initial recognition

- Loan which do not display a significant increase in credit risk

Loans repayable on demand

The loans are effectively repayable within a day or less. Therefore, the entity should assess the borrower’s ability to repay the loan if it were to be demanded at the reporting date. To the extent that adequate accessible liquid assets are available to settle the amount outstanding, no further work is required. In the event that the borrower does not hold sufficient liquid assets to settle the amount outstanding, additional factors should be considered to determine whether the amount outstanding could be recovered through other means.

Loans with remaining term of 12 months or less & no significant increase in credit risk

For loans with a remaining term of 12 months or less, the effect of 12-month and lifetime credit losses will be the same, therefore 12-month credit losses may be utilised. Similarly, for loans where there has not been a significant increase in credit risk, these loans would be in stage 1, and 12-month credit losses should be calculated. In these circumstances, similar considerations to those discussed above should be applied, i.e. consideration should be given to whether the borrower will have sufficient accessible liquid assets to repay the amount outstanding throughout the 12-month period.

Loans with low credit risk

A short-cut method may be applied to loans which are determined to have a low credit risk. One may assume that the probability default (PD) of the lowest level investment grade instrument be applied to a loss given default (LGD) of 100%. If this results in an immaterial ECL, no further work is required. However, if the short-cut above results in a material amount, additional work is required to determine the inputs used in the calculation with consideration given to entity-specific factors.

Loans which display a significant increase in credit risk

These loans would be in either stage 2 or stage 3 of the general impairment model and lifetime expected credit losses should be calculated. As the impairment is considered over the entire lifetime of the loan, the PDs are likely to be higher than for loans within stage 1 of the impairment model, where only 12-month ECLs are determined. Reasonable information (available without undue cost or effort) should be utilised in making this assessment. This includes internal as well as external information, historical as well as forward-looking information.

Decision tree:

© 2020 Nexia SAB&T. ALL Rights Reserved. Nexia SAB&T is a member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the “Member firm disclaimer” for further details.