Entities in a group often provide financing to each other. This financing could be at market terms or at non-market terms. Those loans which are entered into at market terms do not result in significant accounting considerations. This month our focus is on how to calculate the expected credit loss (ECL) on intercompany loans which are repayable on demand.

These loans need to be clearly distinguished from loans which have no repayment terms with no interest as the accounting treatment of those may be significantly different. The latter often results in “equity loans” which is either measured in accordance with IAS 27/IFRS 10 or at fair value in accordance with IFRS 9.

Effectively, a loan which is repayable on demand, contains a contractual repayment term of 1 day or less. Typically, these loans do not accrue interest and have an effective interest rate of 0%. This occurs because the future expected cash flows are equal to the current value of the loan. For purposes of ECL, the appropriate discount rate to be used is therefore also 0%.

The maximum period over which expected impairment losses should be calculated is the longest contractual period over which the lender is exposed to credit risk. In relation to loans repayable on demand, this refers to a period of approximately 1 day.

In determining the impairment provision, the entity should assess the borrower’s ability to repay the loan if it were to be demanded at the reporting date. This requires an assessment of the availability of accessible liquid assets to settle the amount outstanding immediately.

To the extent that adequate accessible liquid assets are available to settle the amount outstanding, no further work is required. Therefore there will be no impairment.

In the event that the borrower does not hold sufficient liquid assets to settle the amount outstanding, the entity should consider whether any of the strategies which may be employed to collect contractual cash flows would result in a recovery of the entire amount outstanding.

If it is not likely that the entire amount outstanding will be recovered, the future cash flows are discounted using the effective interest rate of the loan (0%). Therefore, the impairment loss is simply the difference between the carrying amount and the amount that will be recovered.

If so, the ECL is limited to the effect of time value of money in collecting the expected cash flows. This will likely result in an immaterial ECL as the rate used

to discount the future cash flows would be 0% (the effective interest rate of the loan).

In all instances, when the entity determines the accessible liquid assets available to settle the intercompany loan, consideration should be given to the existence of senior debt which would need to be repaid prior to the repayment of the intercompany loan. The amounts payable with regard to the senior debt should be deducted from the accessible liquid assets in order to determine the amount available to settle the intercompany loan.

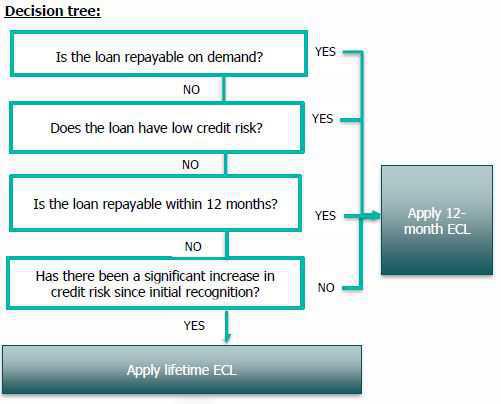

Decision tree:

© 2020 Nexia SAB&T. ALL Rights Reserved. Nexia SAB&T is a member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the “Member firm disclaimer” for further details.