Page 8 - Nexia SAB&T Africa Overview 2025

P. 8

Definitions And Descriptions Of Key

Indicators

Key Economic Indicators: Indicative figures relating to the most recent available

information. A reference to “est” indicates estimated data.

Sovereign Credit Rating: Is an evaluation made by a credit rating agency (such as

Moody’s, Standard and Poor’s or Fitch’s) which evaluates the credit worthiness of the

issuer (country or government) of debt. The credit ratings can give investors insights into

the level of risk associated with investing in the debt of a particular country, including

any political risk.

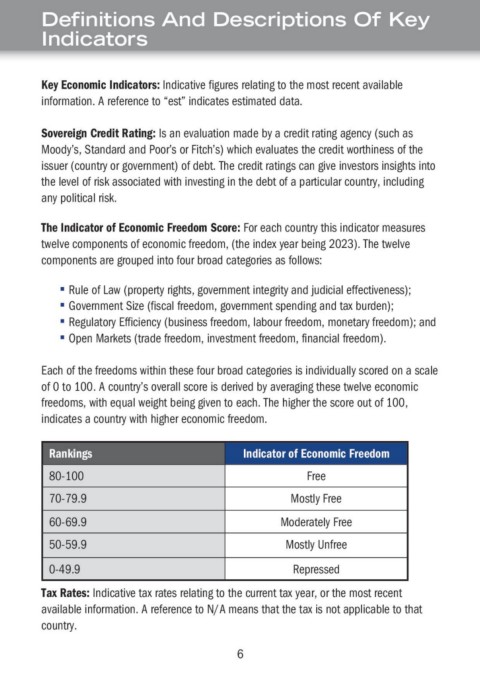

The Indicator of Economic Freedom Score: For each country this indicator measures

twelve components of economic freedom, (the index year being 2023). The twelve

components are grouped into four broad categories as follows:

▪ Rule of Law (property rights, government integrity and judicial effectiveness);

▪ Government Size (fiscal freedom, government spending and tax burden);

▪ Regulatory Efficiency (business freedom, labour freedom, monetary freedom); and

▪ Open Markets (trade freedom, investment freedom, financial freedom).

Each of the freedoms within these four broad categories is individually scored on a scale

of 0 to 100. A country’s overall score is derived by averaging these twelve economic

freedoms, with equal weight being given to each. The higher the score out of 100,

indicates a country with higher economic freedom.

Rankings Indicator of Economic Freedom

80-100 Free

70-79.9 Mostly Free

60-69.9 Moderately Free

50-59.9 Mostly Unfree

0-49.9 Repressed

Tax Rates: Indicative tax rates relating to the current tax year, or the most recent

available information. A reference to N/A means that the tax is not applicable to that

country.

6 7