Page 25 - Nexia SAB&T Estate Planning Guide 2024

P. 25

n At least one independent outsider trustee should be co-appointed as trustee

to every trust in which (a) the trustees are all beneficiaries and (b) the

beneficiaries are all related to each other.

n A trustee can be a beneficiary of a trust, but a sole trustee may not also be

a sole beneficiary of a trust, as a trustee by definition holds and administers

property for some person other than himself.

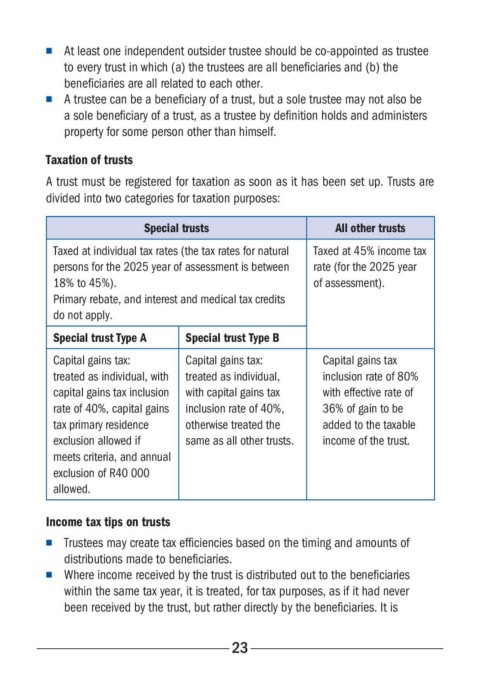

Taxation of trusts

A trust must be registered for taxation as soon as it has been set up. Trusts are

divided into two categories for taxation purposes:

Special trusts All other trusts

Taxed at individual tax rates (the tax rates for natural Taxed at 45% income tax

persons for the 2025 year of assessment is between rate (for the 2025 year

18% to 45%). of assessment).

Primary rebate, and interest and medical tax credits

do not apply.

Special trust Type A Special trust Type B

Capital gains tax: Capital gains tax: Capital gains tax

treated as individual, with treated as individual, inclusion rate of 80%

capital gains tax inclusion with capital gains tax with effective rate of

rate of 40%, capital gains inclusion rate of 40%, 36% of gain to be

tax primary residence otherwise treated the added to the taxable

exclusion allowed if same as all other trusts. income of the trust.

meets criteria, and annual

exclusion of R40 000

allowed.

Income tax tips on trusts

n Trustees may create tax efficiencies based on the timing and amounts of

distributions made to beneficiaries.

n Where income received by the trust is distributed out to the beneficiaries

within the same tax year, it is treated, for tax purposes, as if it had never

been received by the trust, but rather directly by the beneficiaries. It is

23