Page 19 - Nexia SAB&T Business in South Africa Guide 2024

P. 19

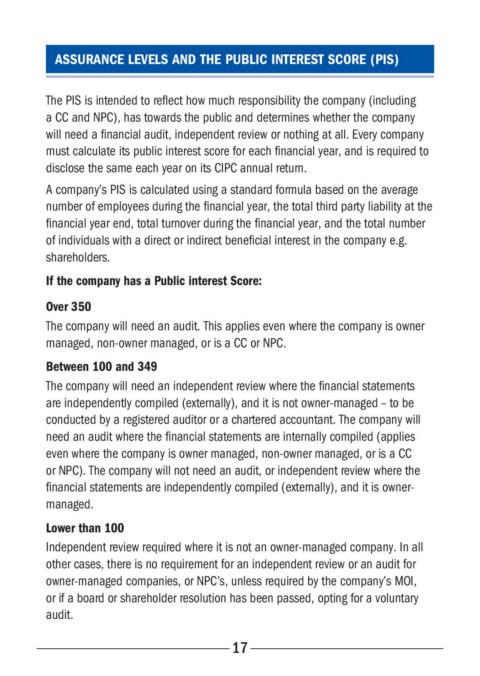

ASSURANCE LEVELS AND THE PUBLIC INTEREST SCORE (PIS)

The PIS is intended to reflect how much responsibility the company (including

a CC and NPC), has towards the public and determines whether the company

will need a financial audit, independent review or nothing at all. Every company

must calculate its public interest score for each financial year, and is required to

disclose the same each year on its CIPC annual return.

A company’s PIS is calculated using a standard formula based on the average

number of employees during the financial year, the total third party liability at the

financial year end, total turnover during the financial year, and the total number

of individuals with a direct or indirect beneficial interest in the company e.g.

shareholders.

If the company has a Public interest Score:

Over 350

The company will need an audit. This applies even where the company is owner

managed, non-owner managed, or is a CC or NPC.

Between 100 and 349

The company will need an independent review where the financial statements

are independently compiled (externally), and it is not owner-managed – to be

conducted by a registered auditor or a chartered accountant. The company will

need an audit where the financial statements are internally compiled (applies

even where the company is owner managed, non-owner managed, or is a CC

or NPC). The company will not need an audit, or independent review where the

financial statements are independently compiled (externally), and it is owner-

managed.

Lower than 100

Independent review required where it is not an owner-managed company. In all

other cases, there is no requirement for an independent review or an audit for

owner-managed companies, or NPC’s, unless required by the company’s MOI,

or if a board or shareholder resolution has been passed, opting for a voluntary

audit.

17