Page 45 - Nexia SAB&T Business in South Africa Guide 2024

P. 45

STANDARD FOR AUTOMATIC EXCHANGE OF FINANCIAL ACCOUNT

INFORMATION IN TAX MATTERS

In recent years, governments and financial institutions have become much more

aware of the large amounts of undisclosed wealth held in offshore accounts.

The Standard for Automatic Exchange of Financial Account Information in Tax

Matters (also referred to as the Common Reporting Standard or CRS) creates

a globally co-ordinated and consistent approach to the disclosure of financial

accounts held by account holders. The agreement requires sharing of information

between the tax authorities regarding accounts and investments.

SA is one of the early adopters of the CRS and is committed to commence

exchange of information automatically on a wider front from 2017, together with

over one hundred other jurisdictions.

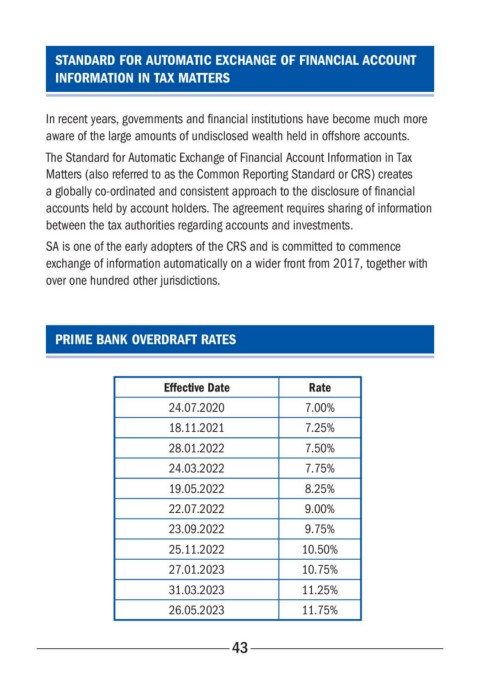

PRIME BANK OVERDRAFT RATES

Effective Date Rate

24.07.2020 7.00%

18.11.2021 7.25%

28.01.2022 7.50%

24.03.2022 7.75%

19.05.2022 8.25%

22.07.2022 9.00%

23.09.2022 9.75%

25.11.2022 10.50%

27.01.2023 10.75%

31.03.2023 11.25%

26.05.2023 11.75%

43