Page 42 - Nexia SAB&T Business in South Africa Guide 2024

P. 42

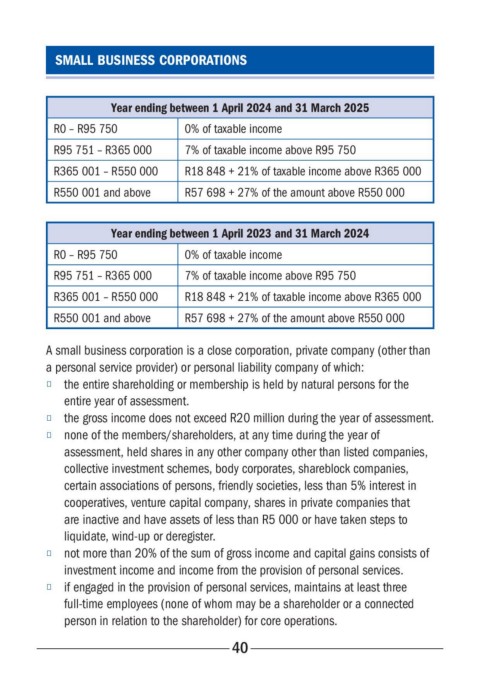

SMALL BUSINESS CORPORATIONS

Year ending between 1 April 2024 and 31 March 2025

R0 – R95 750 0% of taxable income

R95 751 – R365 000 7% of taxable income above R95 750

R365 001 – R550 000 R18 848 + 21% of taxable income above R365 000

R550 001 and above R57 698 + 27% of the amount above R550 000

Year ending between 1 April 2023 and 31 March 2024

R0 – R95 750 0% of taxable income

R95 751 – R365 000 7% of taxable income above R95 750

R365 001 – R550 000 R18 848 + 21% of taxable income above R365 000

R550 001 and above R57 698 + 27% of the amount above R550 000

A small business corporation is a close corporation, private company (other than

a personal service provider) or personal liability company of which:

■ the entire shareholding or membership is held by natural persons for the

entire year of assessment.

■ the gross income does not exceed R20 million during the year of assessment.

■ none of the members/shareholders, at any time during the year of

assessment, held shares in any other company other than listed companies,

collective investment schemes, body corporates, shareblock companies,

certain associations of persons, friendly societies, less than 5% interest in

cooperatives, venture capital company, shares in private companies that

are inactive and have assets of less than R5 000 or have taken steps to

liquidate, wind-up or deregister.

■ not more than 20% of the sum of gross income and capital gains consists of

investment income and income from the provision of personal services.

■ if engaged in the provision of personal services, maintains at least three

full-time employees (none of whom may be a shareholder or a connected

person in relation to the shareholder) for core operations.

40