Page 5 - Nexia SAB&T Estate Planning Guide 2024

P. 5

WHAT IS ESTATE PLANNING?

n An ‘estate’ comprises the assets and liabilities that an estate planner

accumulates during his lifetime, and which he leaves behind at his death.

n ‘Estate planning’ has been defined as the process of creating and managing a

programme that is designed to:

u Preserve, increase and protect an estate planner’s assets during his

lifetime;

u Ensure the most effective and beneficial distribution thereof to succeeding

generations on his death, and in accordance with his wishes.

n A common misconception about estate planning is that it revolves solely

around the making of a Last Will and Testament, or the structuring of an estate

planner’s affairs so as to reduce estate duty.

n Estate planning is multidisciplinary in nature, and should take into account

an individual estate planner’s financial, economical, social, and psychological

needs in relation to his estate, himself, his family and his beneficiaries.

n It is not a once-and-for-all activity. The estate planner should regard it as an

on-going process, with built in flexibility.

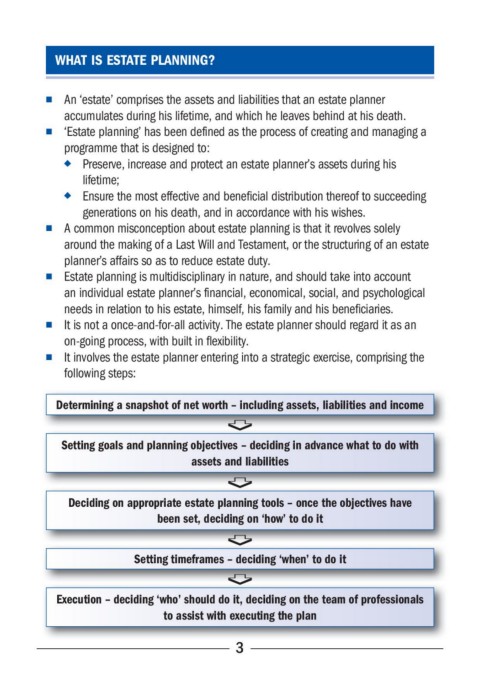

n It involves the estate planner entering into a strategic exercise, comprising the

following steps:

Determining a snapshot of net worth – including assets, liabilities and income

Setting goals and planning objectives – deciding in advance what to do with

assets and liabilities

Deciding on appropriate estate planning tools – once the objectives have

been set, deciding on ‘how’ to do it

Setting timeframes – deciding ‘when’ to do it

Execution – deciding ‘who’ should do it, deciding on the team of professionals

to assist with executing the plan

3