Page 54 - Nexia SAB&T Property & Tax Guide 2022

P. 54

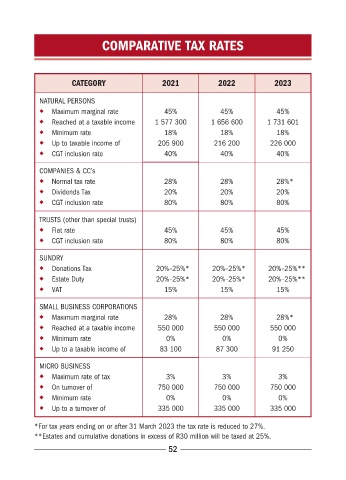

COMPARATIVE TAX RATES

CATEGORY 2021 2022 2023

NATURAL PERSONS

◆ Maximum marginal rate 45% 45% 45%

◆ Reached at a taxable income 1 577 300 1 656 600 1 731 601

◆ Minimum rate 18% 18% 18%

◆ Up to taxable income of 205 900 216 200 226 000

◆ CGT inclusion rate 40% 40% 40%

COMPANIES & CC’s

◆ Normal tax rate 28% 28% 28%*

◆ Dividends Tax 20% 20% 20%

◆ CGT inclusion rate 80% 80% 80%

TRUSTS (other than special trusts)

◆ Flat rate 45% 45% 45%

◆ CGT inclusion rate 80% 80% 80%

SUNDRY

◆ Donations Tax 20%–25%* 20%–25%* 20%–25%**

◆ Estate Duty 20%–25%* 20%–25%* 20%–25%**

◆ VAT 15% 15% 15%

SMALL BUSINESS CORPORATIONS

◆ Maximum marginal rate 28% 28% 28%*

◆ Reached at a taxable income 550 000 550 000 550 000

◆ Minimum rate 0% 0% 0%

◆ Up to a taxable income of 83 100 87 300 91 250

MICRO BUSINESS

◆ Maximum rate of tax 3% 3% 3%

◆ On turnover of 750 000 750 000 750 000

◆ Minimum rate 0% 0% 0%

◆ Up to a turnover of 335 000 335 000 335 000

* For tax years ending on or after 31 March 2023 the tax rate is reduced to 27%.

** Estates and cumulative donations in excess of R30 million will be taxed at 25%.

52