Page 4 - Nexia SAB&T Property and Tax Guide 2024

P. 4

TRANSFER DUTY ON IMMOVABLE PROPERTY

Transfer duty is an indirect tax on the acquisition of immovable property situated in South Africa. The following are

the main provisions:

◆ It is calculated on the value of the immovable property (purchase price or market value whichever is the

highest).

◆ It is payable within six months after the transaction is entered into.

◆ Where a registered VAT vendor purchases property from a non-vendor, the notional input tax is calculated by

multiplying the tax fraction [15/115 (14/114 before 1 April 2018)] by the lesser of the consideration paid or

market value.

◆ The acquisition of a contingent right in a trust that holds a residential property or the shares in a company or

the member’s interest in a close corporation which owns residential property comprising more than 50% of its

assets, is subject to transfer duty at the applicable rate.

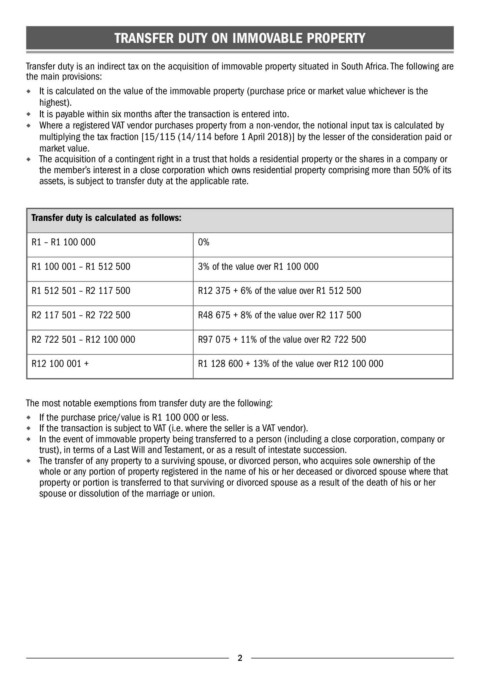

Transfer duty is calculated as follows:

R1 – R1 100 000 0%

R1 100 001 – R1 512 500 3% of the value over R1 100 000

R1 512 501 – R2 117 500 R12 375 + 6% of the value over R1 512 500

R2 117 501 – R2 722 500 R48 675 + 8% of the value over R2 117 500

R2 722 501 – R12 100 000 R97 075 + 11% of the value over R2 722 500

R12 100 001 + R1 128 600 + 13% of the value over R12 100 000

The most notable exemptions from transfer duty are the following:

◆ If the purchase price/value is R1 100 000 or less.

◆ If the transaction is subject to VAT (i.e. where the seller is a VAT vendor).

◆ In the event of immovable property being transferred to a person (including a close corporation, company or

trust), in terms of a Last Will and Testament, or as a result of intestate succession.

◆ The transfer of any property to a surviving spouse, or divorced person, who acquires sole ownership of the

whole or any portion of property registered in the name of his or her deceased or divorced spouse where that

property or portion is transferred to that surviving or divorced spouse as a result of the death of his or her

spouse or dissolution of the marriage or union.

2