Page 5 - Nexia SAB&T Property and Tax Guide 2024

P. 5

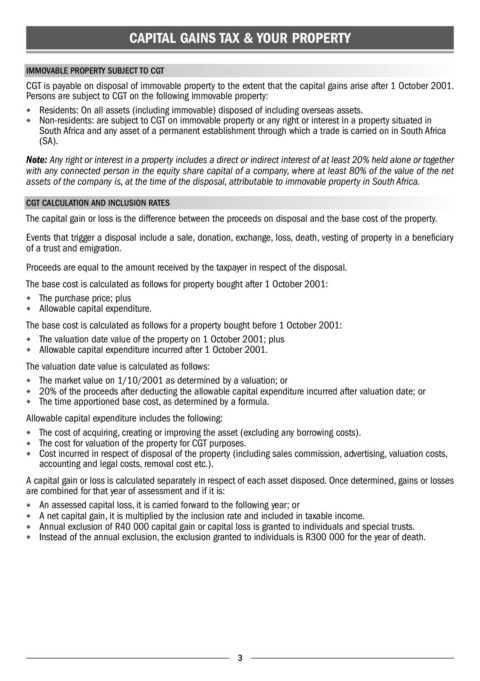

CAPITAL GAINS TAX & YOUR PROPERTY

IMMOVABLE PROPERTY SUBJECT TO CGT

CGT is payable on disposal of immovable property to the extent that the capital gains arise after 1 October 2001.

Persons are subject to CGT on the following immovable property:

◆ Residents: On all assets (including immovable) disposed of including overseas assets.

◆ Non-residents: are subject to CGT on immovable property or any right or interest in a property situated in

South Africa and any asset of a permanent establishment through which a trade is carried on in South Africa

(SA).

Note: Any right or interest in a property includes a direct or indirect interest of at least 20% held alone or together

with any connected person in the equity share capital of a company, where at least 80% of the value of the net

assets of the company is, at the time of the disposal, attributable to immovable property in South Africa.

CGT CALCULATION AND INCLUSION RATES

The capital gain or loss is the difference between the proceeds on disposal and the base cost of the property.

Events that trigger a disposal include a sale, donation, exchange, loss, death, vesting of property in a beneficiary

of a trust and emigration.

Proceeds are equal to the amount received by the taxpayer in respect of the disposal.

The base cost is calculated as follows for property bought after 1 October 2001:

◆ The purchase price; plus

◆ Allowable capital expenditure.

The base cost is calculated as follows for a property bought before 1 October 2001:

◆ The valuation date value of the property on 1 October 2001; plus

◆ Allowable capital expenditure incurred after 1 October 2001.

The valuation date value is calculated as follows:

◆ The market value on 1/10/2001 as determined by a valuation; or

◆ 20% of the proceeds after deducting the allowable capital expenditure incurred after valuation date; or

◆ The time apportioned base cost, as determined by a formula.

Allowable capital expenditure includes the following:

◆ The cost of acquiring, creating or improving the asset (excluding any borrowing costs).

◆ The cost for valuation of the property for CGT purposes.

◆ Cost incurred in respect of disposal of the property (including sales commission, advertising, valuation costs,

accounting and legal costs, removal cost etc.).

A capital gain or loss is calculated separately in respect of each asset disposed. Once deter mined, gains or losses

are combined for that year of assessment and if it is:

◆ An assessed capital loss, it is carried forward to the following year; or

◆ A net capital gain, it is multiplied by the inclusion rate and included in taxable income.

◆ Annual exclusion of R40 000 capital gain or capital loss is granted to individuals and special trusts.

◆ Instead of the annual exclusion, the exclusion granted to individuals is R300 000 for the year of death.

3