Page 16 - Nexia SAB&T Property and Tax Guide 2025

P. 16

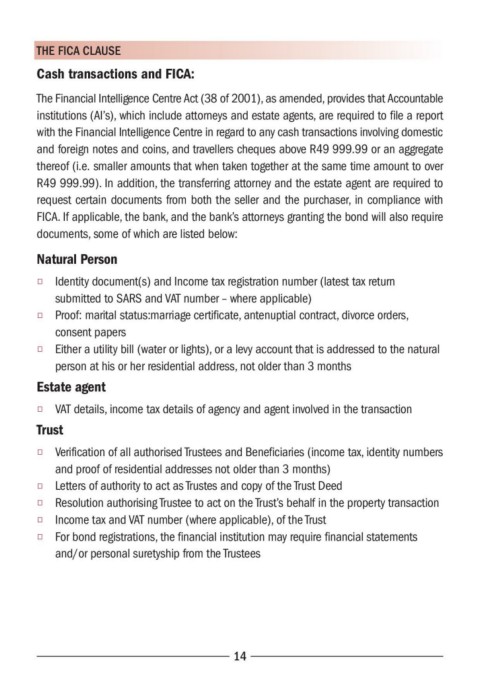

THE FICA CLAUSE

Cash transactions and FICA:

The Financial Intelligence Centre Act (38 of 2001), as amended, provides that Accountable

institutions (AI’s), which include attorneys and estate agents, are required to file a report

with the Financial Intelligence Centre in regard to any cash transactions involving domestic

and foreign notes and coins, and travellers cheques above R49 999.99 or an aggregate

thereof (i.e. smaller amounts that when taken together at the same time amount to over

R49 999.99). In addition, the transferring attorney and the estate agent are required to

request certain documents from both the seller and the purchaser, in compliance with

FICA. If applicable, the bank, and the bank’s attorneys granting the bond will also require

documents, some of which are listed below:

Natural Person

◆ Identity document(s) and Income tax registration number (latest tax return

submitted to SARS and VAT number – where applicable)

◆ Proof: marital status:marriage certificate, antenuptial contract, divorce orders,

consent papers

◆ Either a utility bill (water or lights), or a levy account that is addressed to the natural

person at his or her residential address, not older than 3 months

Estate agent

◆ VAT details, income tax details of agency and agent involved in the transaction

Trust

◆ Verification of all authorised Trustees and Beneficiaries (income tax, identity numbers

and proof of residential addresses not older than 3 months)

◆ Letters of authority to act as Trustes and copy of the Trust Deed

◆ Resolution authorising Trustee to act on the Trust’s behalf in the property transaction

◆ Income tax and VAT number (where applicable), of the Trust

◆ For bond registrations, the financial institution may require financial statements

and/or personal suretyship from the Trustees

14