Page 11 - Nexia SAB&T Property and Tax Guide 2025

P. 11

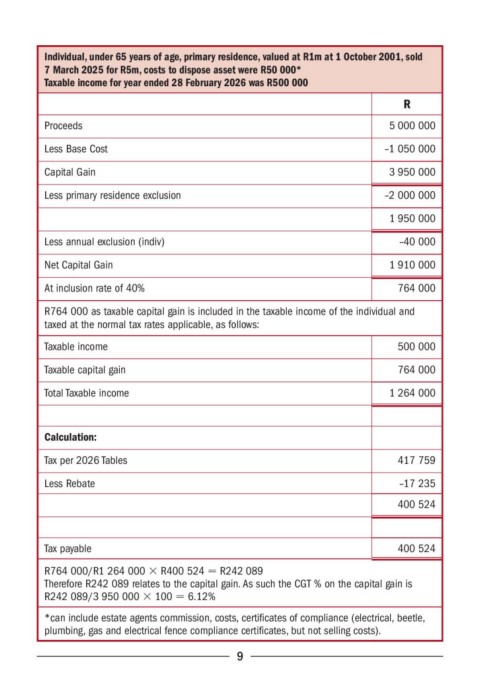

Individual, under 65 years of age, primary residence, valued at R1m at 1 October 2001, sold

7 March 2025 for R5m, costs to dispose asset were R50 000*

Taxable income for year ended 28 February 2026 was R500 000

R

Proceeds 5 000 000

Less Base Cost –1 050 000

Capital Gain 3 950 000

Less primary residence exclusion –2 000 000

1 950 000

Less annual exclusion (indiv) –40 000

Net Capital Gain 1 910 000

At inclusion rate of 40% 764 000

R764 000 as taxable capital gain is included in the taxable income of the individual and

taxed at the normal tax rates applicable, as follows:

Taxable income 500 000

Taxable capital gain 764 000

Total Taxable income 1 264 000

Calculation:

Tax per 2026 Tables 417 759

Less Rebate –17 235

400 524

Tax payable 400 524

R764 000/R1 264 000 × R400 524 = R242 089

Therefore R242 089 relates to the capital gain. As such the CGT % on the capital gain is

R242 089/3 950 000 × 100 = 6.12%

*can include estate agents commission, costs, certificates of compliance (electrical, beetle,

plumbing, gas and electrical fence compliance certificates, but not selling costs).

9