Page 16 - Nexia SAB&T Trust Guide 2024

P. 16

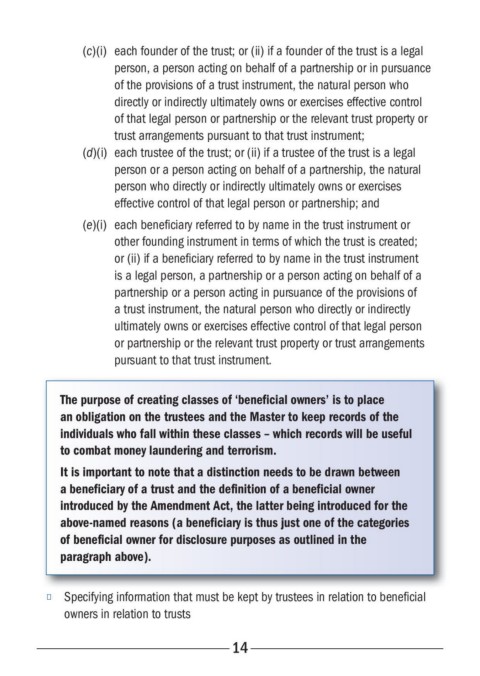

(c)(i) each founder of the trust; or (ii) if a founder of the trust is a legal

person, a person acting on behalf of a partnership or in pursuance

of the provisions of a trust instrument, the natural person who

directly or indirectly ultimately owns or exercises effective control

of that legal person or partnership or the relevant trust property or

trust arrangements pursuant to that trust instrument;

(d)(i) each trustee of the trust; or (ii) if a trustee of the trust is a legal

person or a person acting on behalf of a partnership, the natural

person who directly or indirectly ultimately owns or exercises

effective control of that legal person or partnership; and

(e)(i) each beneficiary referred to by name in the trust instrument or

other founding instrument in terms of which the trust is created;

or (ii) if a beneficiary referred to by name in the trust instrument

is a legal person, a partnership or a person acting on behalf of a

partnership or a person acting in pursuance of the provisions of

a trust instrument, the natural person who directly or indirectly

ultimately owns or exercises effective control of that legal person

or partnership or the relevant trust property or trust arrangements

pursuant to that trust instrument.

The purpose of creating classes of ‘beneficial owners’ is to place

an obligation on the trustees and the Master to keep records of the

individuals who fall within these classes – which records will be useful

to combat money laundering and terrorism.

It is important to note that a distinction needs to be drawn between

a beneficiary of a trust and the definition of a beneficial owner

introduced by the Amendment Act, the latter being introduced for the

above-named reasons (a beneficiary is thus just one of the categories

of beneficial owner for disclosure purposes as outlined in the

paragraph above).

■ Specifying information that must be kept by trustees in relation to beneficial

owners in relation to trusts

14