Page 21 - Nexia SAB&T Trust Guide 2024

P. 21

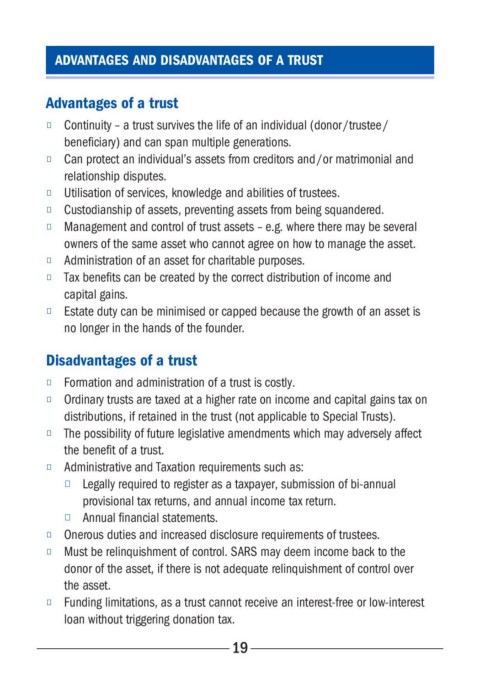

ADVANTAGES AND DISADVANTAGES OF A TRUST

Advantages of a trust

■ Continuity – a trust survives the life of an individual (donor /trustee /

beneficiary) and can span multiple generations.

■ Can protect an individual’s assets from creditors and /or matrimonial and

relationship disputes.

■ Utilisation of services, knowledge and abilities of trustees.

■ Custodianship of assets, preventing assets from being squandered.

■ Management and control of trust assets – e.g. where there may be several

owners of the same asset who cannot agree on how to manage the asset.

■ Administration of an asset for charitable purposes.

■ Tax benefits can be created by the correct distribution of income and

capital gains.

■ Estate duty can be minimised or capped because the growth of an asset is

no longer in the hands of the founder.

Disadvantages of a trust

■ Formation and administration of a trust is costly.

■ Ordinary trusts are taxed at a higher rate on income and capital gains tax on

distributions, if retained in the trust (not applicable to Special Trusts).

■ The possibility of future legislative amendments which may adversely affect

the benefit of a trust.

■ Administrative and Taxation requirements such as:

■ Legally required to register as a taxpayer, submission of bi-annual

provisional tax returns, and annual income tax return.

■ Annual financial statements.

■ Onerous duties and increased disclosure requirements of trustees.

■ Must be relinquishment of control. SARS may deem income back to the

donor of the asset, if there is not adequate relinquishment of control over

the asset.

■ Funding limitations, as a trust cannot receive an interest-free or low-interest

loan without triggering donation tax.

19