Page 48 - Nexia SAB&T Trust Guide 2024

P. 48

Other anti-avoidance provisions for trusts

Anti-avoidance provisions exist to combat the use of trusts for income splitting

and tax avoidance schemes. These provisions will normally be applicable where

income accrues to a person other than the donor as a result of a donation,

settlement or other disposition made (i.e. interest free loans). These provisions

may apply where income accrues to the following persons:

■ The donor’s spouse

■ A minor child of the donor

■ The trust to whom the donation, settlement or other disposition has been

made

■ Non-residents

The result of the anti-avoidance provisions are that the income that accrues to

the person’s mentioned above are deemed to be the income of the donor.

Withholding Tax on Acquisition of Property from Non-Resident

by a Trust

The purchaser (trust) must withhold CGT on the purchase price where immovable

property are purchased from a non-resident except where the amount payable by

the purchaser is less than R2 million. The amount withheld is an advance tax in

respect of the sellers’ liability for CGT. This withholding tax is not a final tax and is

merely a prepayment of the expected CGT.

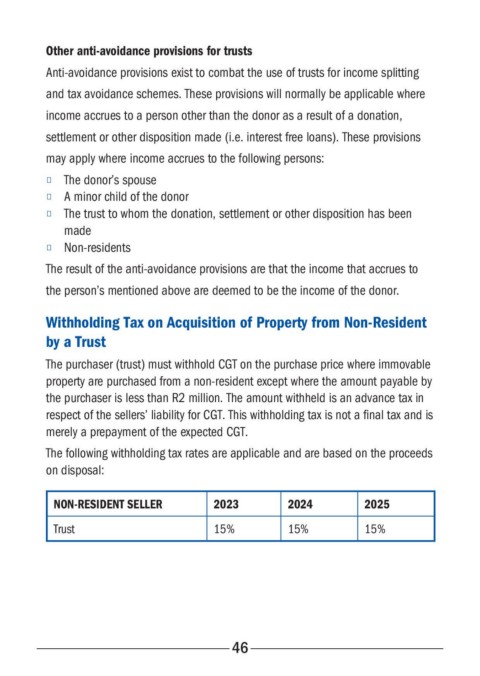

The following withholding tax rates are applicable and are based on the proceeds

on disposal:

NON-RESIDENT SELLER 2023 2024 2025

Trust 15% 15% 15%

46