Page 53 - Nexia SAB&T Trust Guide 2024

P. 53

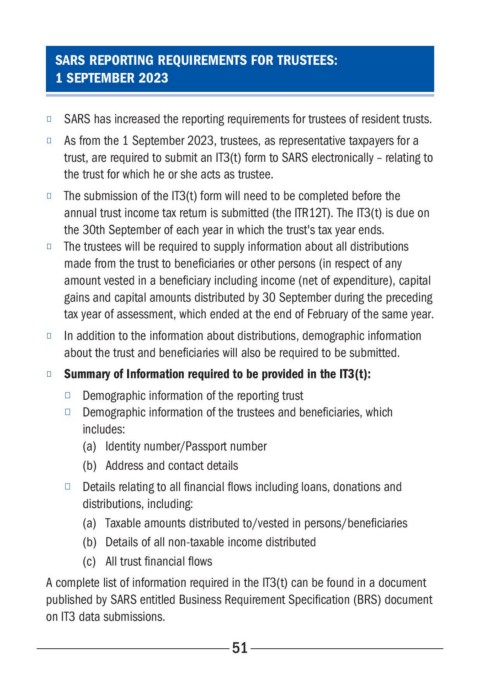

SARS REPORTING REQUIREMENTS FOR TRUSTEES:

1 SEPTEMBER 2023

■ SARS has increased the reporting requirements for trustees of resident trusts.

■ As from the 1 September 2023, trustees, as representative taxpayers for a

trust, are required to submit an IT3(t) form to SARS electronically – relating to

the trust for which he or she acts as trustee.

■ The submission of the IT3(t) form will need to be completed before the

annual trust income tax return is submitted (the ITR12T). The IT3(t) is due on

the 30th September of each year in which the trust's tax year ends.

■ The trustees will be required to supply information about all distributions

made from the trust to beneficiaries or other persons (in respect of any

amount vested in a beneficiary including income (net of expenditure), capital

gains and capital amounts distributed by 30 September during the preceding

tax year of assessment, which ended at the end of February of the same year.

■ In addition to the information about distributions, demographic information

about the trust and beneficiaries will also be required to be submitted.

■ Summary of Information required to be provided in the IT3(t):

■ Demographic information of the reporting trust

■ Demographic information of the trustees and beneficiaries, which

includes:

(a) Identity number/Passport number

(b) Address and contact details

■ Details relating to all financial flows including loans, donations and

distributions, including:

(a) Taxable amounts distributed to/vested in persons/beneficiaries

(b) Details of all non-taxable income distributed

(c) All trust financial flows

A complete list of information required in the IT3(t) can be found in a document

published by SARS entitled Business Requirement Specification (BRS) document

on IT3 data submissions.

51