Page 17 - Nexia SAB&T Trust Guide 2022

P. 17

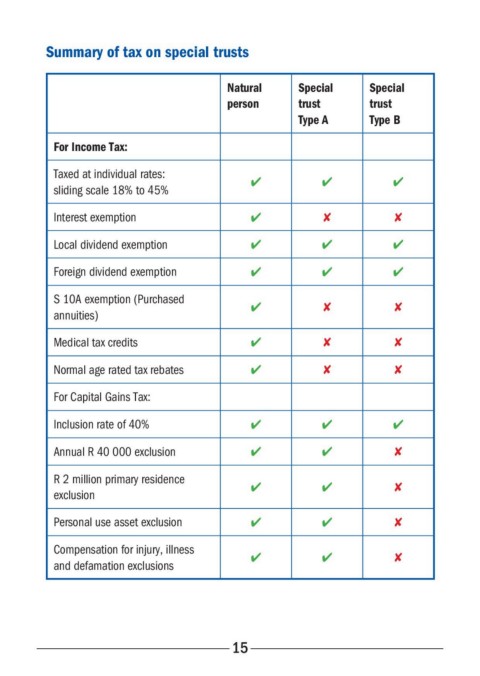

Summary of tax on special trusts

Natural Special Special

person trust trust

Type A Type B

For Income Tax:

Taxed at individual rates:

sliding scale 18% to 45% ✔ ✔ ✔

Interest exemption ✔ ✘ ✘

Local dividend exemption ✔ ✔ ✔

Foreign dividend exemption ✔ ✔ ✔

S 10A exemption (Purchased ✔ ✘ ✘

annuities)

Medical tax credits ✔ ✘ ✘

Normal age rated tax rebates ✔ ✘ ✘

For Capital Gains Tax:

Inclusion rate of 40% ✔ ✔ ✔

Annual R 40 000 exclusion ✔ ✔ ✘

R 2 million primary residence ✔ ✔ ✘

exclusion

Personal use asset exclusion ✔ ✔ ✘

Compensation for injury, illness ✔ ✔ ✘

and defamation exclusions

15