Page 19 - Nexia SAB&T Trust Guide 2022

P. 19

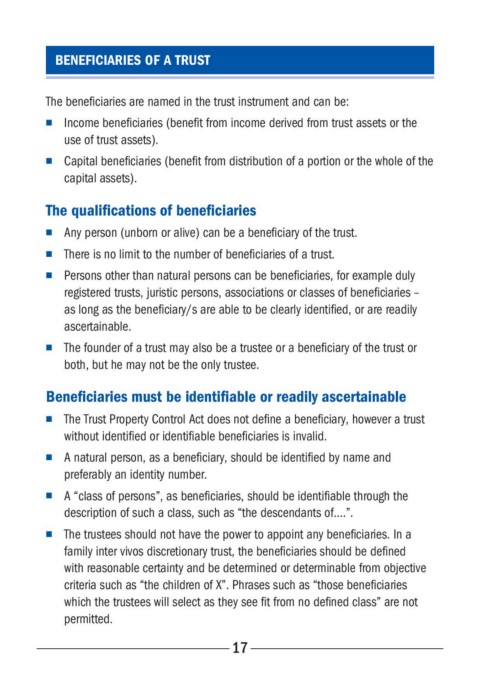

BENEFICIARIES OF A TRUST

The beneficiaries are named in the trust instrument and can be:

■ Income beneficiaries (benefit from income derived from trust assets or the

use of trust assets).

■ Capital beneficiaries (benefit from distribution of a portion or the whole of the

capital assets).

The qualifications of beneficiaries

■ Any person (unborn or alive) can be a beneficiary of the trust.

■ There is no limit to the number of beneficiaries of a trust.

■ Persons other than natural persons can be beneficiaries, for example duly

registered trusts, juristic persons, associations or classes of beneficiaries –

as long as the beneficiary/s are able to be clearly identified, or are readily

ascertainable.

■ The founder of a trust may also be a trustee or a beneficiary of the trust or

both, but he may not be the only trustee.

Beneficiaries must be identifiable or readily ascertainable

■ The Trust Property Control Act does not define a beneficiary, however a trust

without identified or identifiable beneficiaries is invalid.

■ A natural person, as a beneficiary, should be identified by name and

preferably an identity number.

■ A “class of persons”, as beneficiaries, should be identifiable through the

description of such a class, such as “the descendants of....”.

■ The trustees should not have the power to appoint any beneficiaries. In a

family inter vivos discretionary trust, the beneficiaries should be defined

with reasonable certainty and be determined or determinable from objective

criteria such as “the children of X”. Phrases such as “those beneficiaries

which the trustees will select as they see fit from no defined class” are not

permitted.

17