Page 44 - Nexia SAB&T Trust Guide 2022

P. 44

TAXATION OF TRUSTS

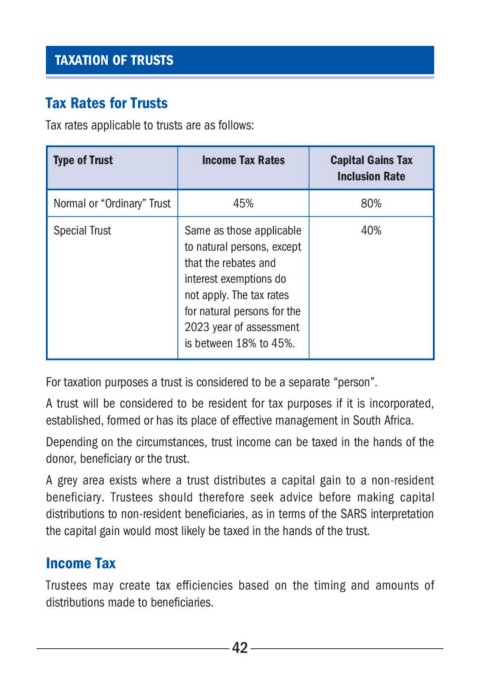

Tax Rates for Trusts

Tax rates applicable to trusts are as follows:

Type of Trust Income Tax Rates Capital Gains Tax

Inclusion Rate

Normal or “Ordinary” Trust 45% 80%

Special Trust Same as those applicable 40%

to natural persons, except

that the rebates and

interest exemptions do

not apply. The tax rates

for natural persons for the

2023 year of assessment

is between 18% to 45%.

For taxation purposes a trust is considered to be a separate “person”.

A trust will be considered to be resident for tax purposes if it is incorporated,

established, formed or has its place of effective management in South Africa.

Depending on the circumstances, trust income can be taxed in the hands of the

donor, beneficiary or the trust.

A grey area exists where a trust distributes a capital gain to a non-resident

beneficiary. Trustees should therefore seek advice before making capital

distributions to non-resident beneficiaries, as in terms of the SARS interpretation

the capital gain would most likely be taxed in the hands of the trust.

Income Tax

Trustees may create tax efficiencies based on the timing and amounts of

distributions made to beneficiaries.

42