Page 29 - Nexia SAB&T Business in South Africa Guide 2024

P. 29

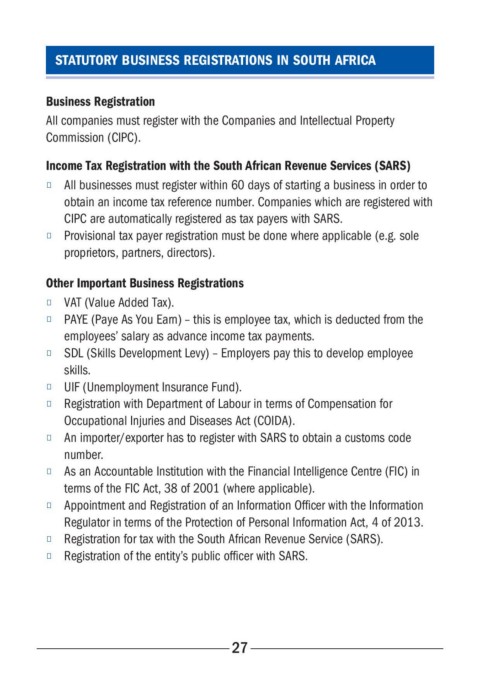

STATUTORY BUSINESS REGISTRATIONS IN SOUTH AFRICA

Business Registration

All companies must register with the Companies and Intellectual Property

Commission (CIPC).

Income Tax Registration with the South African Revenue Services (SARS)

■ All businesses must register within 60 days of starting a business in order to

obtain an income tax reference number. Companies which are registered with

CIPC are automatically registered as tax payers with SARS.

■ Provisional tax payer registration must be done where applicable (e.g. sole

proprietors, partners, directors).

Other Important Business Registrations

■ VAT (Value Added Tax).

■ PAYE (Paye As You Earn) – this is employee tax, which is deducted from the

employees’ salary as advance income tax payments.

■ SDL (Skills Development Levy) – Employers pay this to develop employee

skills.

■ UIF (Unemployment Insurance Fund).

■ Registration with Department of Labour in terms of Compensation for

Occupational Injuries and Diseases Act (COIDA).

■ An importer/exporter has to register with SARS to obtain a customs code

number.

■ As an Accountable Institution with the Financial Intelligence Centre (FIC) in

terms of the FIC Act, 38 of 2001 (where applicable).

■ Appointment and Registration of an Information Officer with the Information

Regulator in terms of the Protection of Personal Information Act, 4 of 2013.

■ Registration for tax with the South African Revenue Service (SARS).

■ Registration of the entity’s public officer with SARS.

27