Page 34 - Nexia SAB&T Business in South Africa Guide 2024

P. 34

Withholding tax on acquisition of property from non-resident

The purchaser must withhold CGT on the purchase price where assets are

purchased from a non-resident except where the amount payable by the

purchaser is less than R2 million. The amount withheld is an advance tax in

respect of the sellers’ liability for CGT.

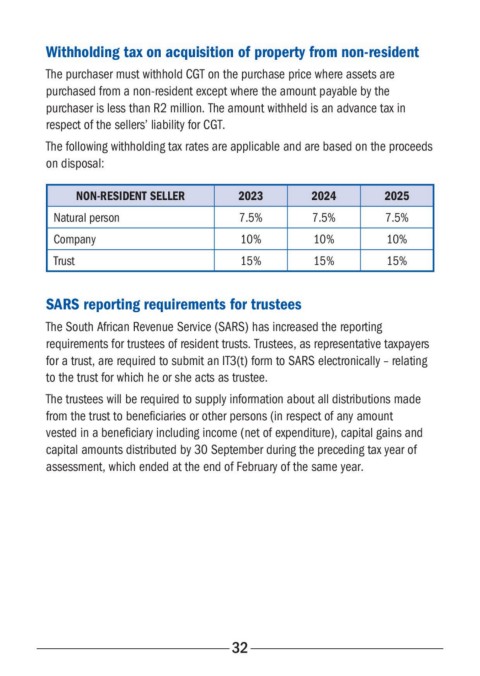

The following withholding tax rates are applicable and are based on the proceeds

on disposal:

NON-RESIDENT SELLER 2023 2024 2025

Natural person 7.5% 7.5% 7.5%

Company 10% 10% 10%

Trust 15% 15% 15%

SARS reporting requirements for trustees

The South African Revenue Service (SARS) has increased the reporting

requirements for trustees of resident trusts. Trustees, as representative taxpayers

for a trust, are required to submit an IT3(t) form to SARS electronically – relating

to the trust for which he or she acts as trustee.

The trustees will be required to supply information about all distributions made

from the trust to beneficiaries or other persons (in respect of any amount

vested in a beneficiary including income (net of expenditure), capital gains and

capital amounts distributed by 30 September during the preceding tax year of

assessment, which ended at the end of February of the same year.

32