Page 56 - Nexia SAB&T Business in South Africa Guide 2024

P. 56

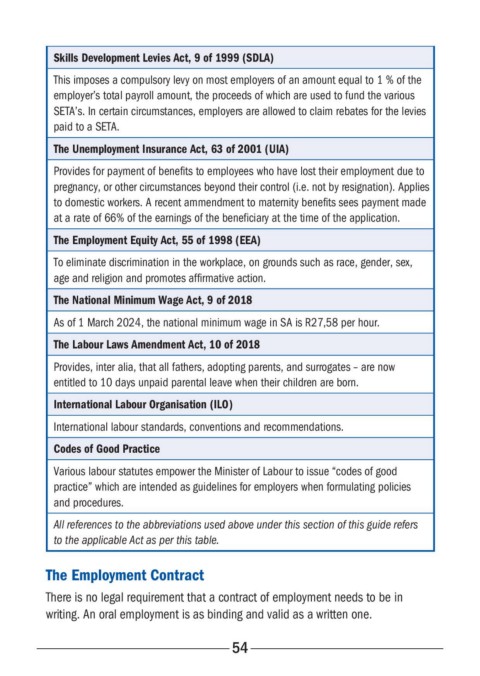

Skills Development Levies Act, 9 of 1999 (SDLA)

This imposes a compulsory levy on most employers of an amount equal to 1 % of the

employer’s total payroll amount, the proceeds of which are used to fund the various

SETA’s. In certain circumstances, employers are allowed to claim rebates for the levies

paid to a SETA.

The Unemployment Insurance Act, 63 of 2001 (UIA)

Provides for payment of benefits to employees who have lost their employment due to

pregnancy, or other circumstances beyond their control (i.e. not by resignation). Applies

to domestic workers. A recent ammendment to maternity benefits sees payment made

at a rate of 66% of the earnings of the beneficiary at the time of the application.

The Employment Equity Act, 55 of 1998 (EEA)

To eliminate discrimination in the workplace, on grounds such as race, gender, sex,

age and religion and promotes affirmative action.

The National Minimum Wage Act, 9 of 2018

As of 1 March 2024, the national minimum wage in SA is R27,58 per hour.

The Labour Laws Amendment Act, 10 of 2018

Provides, inter alia, that all fathers, adopting parents, and surrogates – are now

entitled to 10 days unpaid parental leave when their children are born.

International Labour Organisation (ILO)

International labour standards, conventions and recommendations.

Codes of Good Practice

Various labour statutes empower the Minister of Labour to issue “codes of good

practice” which are intended as guidelines for employers when formulating policies

and procedures.

All references to the abbreviations used above under this section of this guide refers

to the applicable Act as per this table.

The Employment Contract

There is no legal requirement that a contract of employment needs to be in

writing. An oral employment is as binding and valid as a written one.

54