Page 58 - Nexia SAB&T Business in South Africa Guide 2024

P. 58

are misconduct, incapacity (ill health or poor work performance) and operational

requirements of the employer. Payment on dismissal includes accrued annual leave

pay, payment in lieu of notice – unless summarily dismissed or if the employee is

required to work the notice period. If dismissal is due to operational requirements,

severance pay of a minimum of one week’s salary for every completed year of

service, and any other amount that the employee is contractually entitled to.

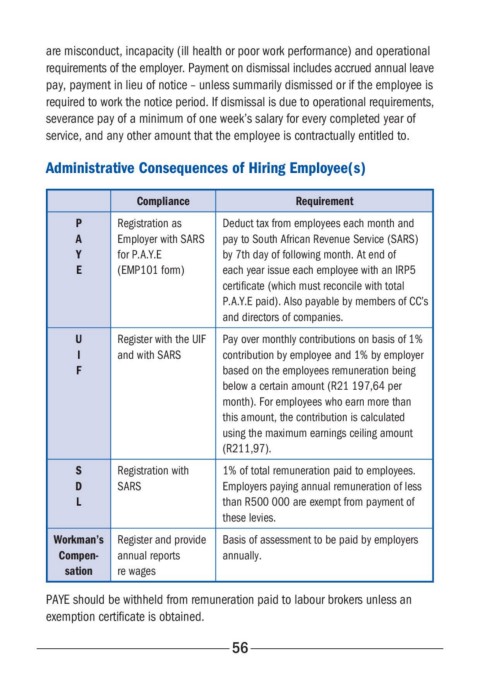

Administrative Consequences of Hiring Employee(s)

Compliance Requirement

P Registration as Deduct tax from employees each month and

A Employer with SARS pay to South African Revenue Service (SARS)

Y for P.A.Y.E by 7th day of following month. At end of

E (EMP101 form) each year issue each employee with an IRP5

certificate (which must reconcile with total

P.A.Y.E paid). Also payable by members of CC’s

and directors of companies.

U Register with the UIF Pay over monthly contributions on basis of 1%

I and with SARS contribution by employee and 1% by employer

F based on the employees remuneration being

below a certain amount (R21 197,64 per

month). For employees who earn more than

this amount, the contribution is calculated

using the maximum earnings ceiling amount

(R211,97).

S Registration with 1% of total remuneration paid to employees.

D SARS Employers paying annual remuneration of less

L than R500 000 are exempt from payment of

these levies.

Workman’s Register and provide Basis of assessment to be paid by employers

Compen- annual reports annually.

sation re wages

PAYE should be withheld from remuneration paid to labour brokers unless an

exemption certificate is obtained.

56