Page 56 - Nexia SAB&T Estate Planning Guide 2024

P. 56

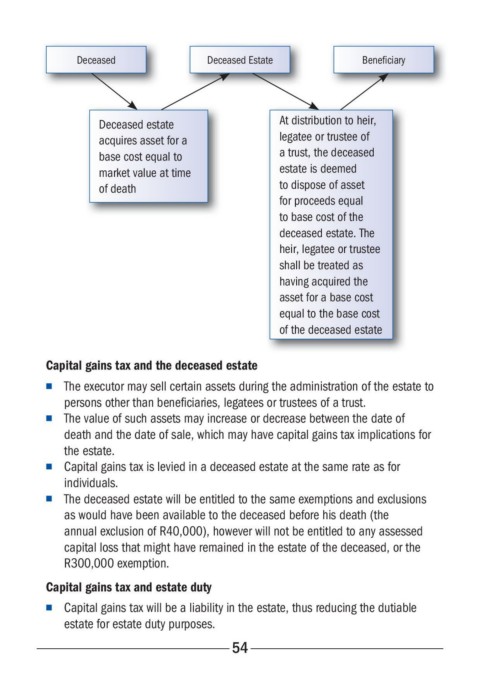

Deceased Deceased Estate Beneficiary

Deceased estate At distribution to heir,

acquires asset for a legatee or trustee of

base cost equal to a trust, the deceased

market value at time estate is deemed

of death to dispose of asset

for proceeds equal

to base cost of the

deceased estate. The

heir, legatee or trustee

shall be treated as

having acquired the

asset for a base cost

equal to the base cost

of the deceased estate

Capital gains tax and the deceased estate

n The executor may sell certain assets during the administration of the estate to

persons other than beneficiaries, legatees or trustees of a trust.

n The value of such assets may increase or decrease between the date of

death and the date of sale, which may have capital gains tax implications for

the estate.

n Capital gains tax is levied in a deceased estate at the same rate as for

individuals.

n The deceased estate will be entitled to the same exemptions and exclusions

as would have been available to the deceased before his death (the

annual exclusion of R40,000), however will not be entitled to any assessed

capital loss that might have remained in the estate of the deceased, or the

R300,000 exemption.

Capital gains tax and estate duty

n Capital gains tax will be a liability in the estate, thus reducing the dutiable

estate for estate duty purposes.

54