Page 23 - Nexia SAB&T Property and Tax Guide 2025

P. 23

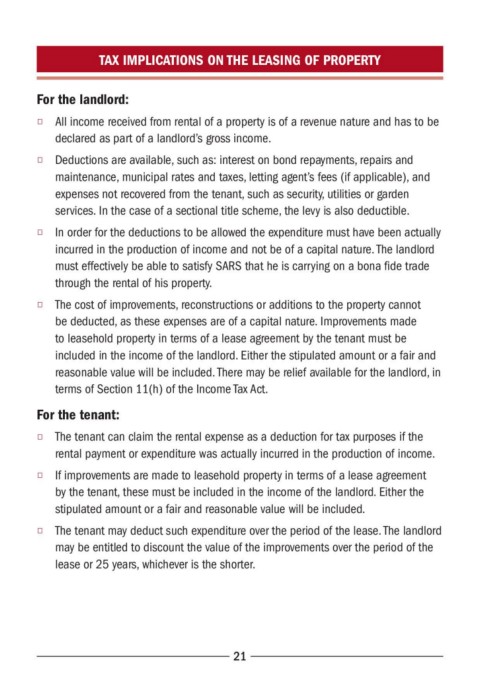

TAX IMPLICATIONS ON THE LEASING OF PROPERTY

For the landlord:

◆ All income received from rental of a property is of a revenue nature and has to be

declared as part of a landlord’s gross income.

◆ Deductions are available, such as: interest on bond repayments, repairs and

maintenance, municipal rates and taxes, letting agent’s fees (if applicable), and

expenses not recovered from the tenant, such as security, utilities or garden

services. In the case of a sectional title scheme, the levy is also deductible.

◆ In order for the deductions to be allowed the expenditure must have been actually

incurred in the production of income and not be of a capital nature. The landlord

must effectively be able to satisfy SARS that he is carrying on a bona fide trade

through the rental of his property.

◆ The cost of improvements, reconstructions or additions to the property cannot

be deducted, as these expenses are of a capital nature. Improvements made

to leasehold property in terms of a lease agreement by the tenant must be

included in the income of the landlord. Either the stipulated amount or a fair and

reasonable value will be included. There may be relief available for the landlord, in

terms of Section 11(h) of the Income Tax Act.

For the tenant:

◆ The tenant can claim the rental expense as a deduction for tax purposes if the

rental payment or expenditure was actually incurred in the production of income.

◆ If improvements are made to leasehold property in terms of a lease agreement

by the tenant, these must be included in the income of the landlord. Either the

stipulated amount or a fair and reasonable value will be included.

◆ The tenant may deduct such expenditure over the period of the lease. The landlord

may be entitled to discount the value of the improvements over the period of the

lease or 25 years, whichever is the shorter.

21