Page 26 - Nexia SAB&T Property and Tax Guide 2025

P. 26

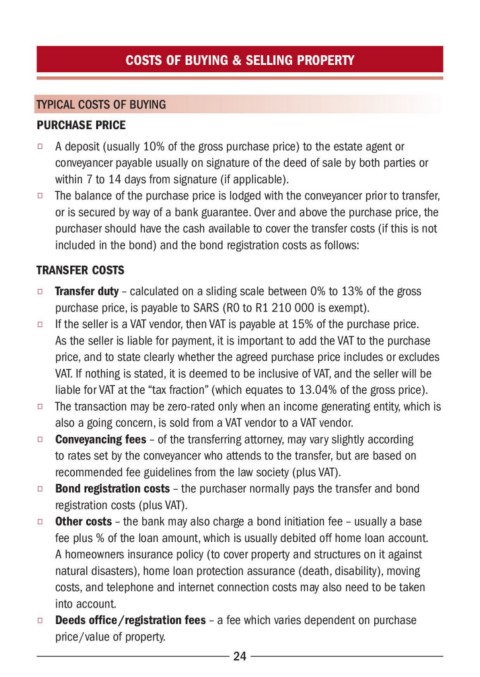

COSTS OF BUYING & SELLING PROPERTY

TYPICAL COSTS OF BUYING

PURCHASE PRICE

◆ A deposit (usually 10% of the gross purchase price) to the estate agent or

conveyancer payable usually on signature of the deed of sale by both parties or

within 7 to 14 days from signature (if applicable).

◆ The balance of the purchase price is lodged with the conveyancer prior to transfer,

or is secured by way of a bank guarantee. Over and above the purchase price, the

purchaser should have the cash available to cover the transfer costs (if this is not

included in the bond) and the bond registration costs as follows:

TRANSFER COSTS

◆ Transfer duty – calculated on a sliding scale between 0% to 13% of the gross

purchase price, is payable to SARS (R0 to R1 210 000 is exempt).

◆ If the seller is a VAT vendor, then VAT is payable at 15% of the purchase price.

As the seller is liable for payment, it is important to add the VAT to the purchase

price, and to state clearly whether the agreed purchase price includes or excludes

VAT. If nothing is stated, it is deemed to be inclusive of VAT, and the seller will be

liable for VAT at the “tax fraction” (which equates to 13.04% of the gross price).

◆ The transaction may be zero-rated only when an income generating entity, which is

also a going concern, is sold from a VAT vendor to a VAT vendor.

◆ Conveyancing fees – of the transferring attorney, may vary slightly according

to rates set by the conveyancer who attends to the transfer, but are based on

recommended fee guidelines from the law society (plus VAT).

◆ Bond registration costs – the purchaser normally pays the transfer and bond

registration costs (plus VAT).

◆ Other costs – the bank may also charge a bond initiation fee – usually a base

fee plus % of the loan amount, which is usually debited off home loan account.

A homeowners insurance policy (to cover property and structures on it against

natural disasters), home loan protection assurance (death, disability), moving

costs, and telephone and internet connection costs may also need to be taken

into account.

◆ Deeds office /registration fees – a fee which varies dependent on purchase

price /value of property.

24