Page 37 - Nexia SAB&T Business in South Africa Guide 2024

P. 37

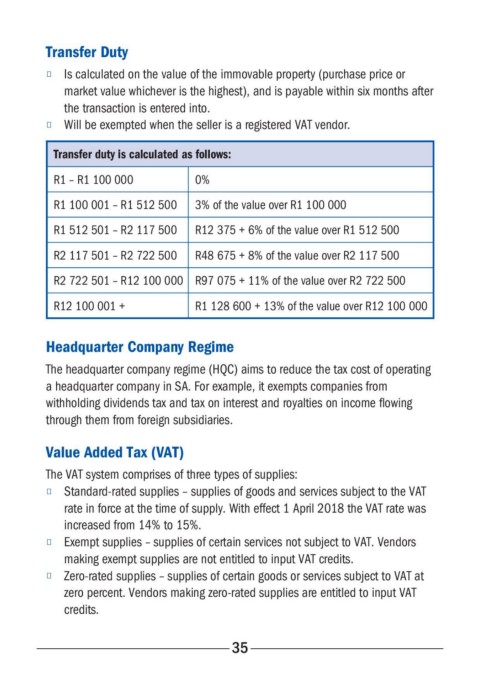

Transfer Duty

■ Is calculated on the value of the immovable property (purchase price or

market value whichever is the highest), and is payable within six months after

the transaction is entered into.

■ Will be exempted when the seller is a registered VAT vendor.

Transfer duty is calculated as follows:

R1 – R1 100 000 0%

R1 100 001 – R1 512 500 3% of the value over R1 100 000

R1 512 501 – R2 117 500 R12 375 + 6% of the value over R1 512 500

R2 117 501 – R2 722 500 R48 675 + 8% of the value over R2 117 500

R2 722 501 – R12 100 000 R97 075 + 11% of the value over R2 722 500

R12 100 001 + R1 128 600 + 13% of the value over R12 100 000

Headquarter Company Regime

The headquarter company regime (HQC) aims to reduce the tax cost of operating

a headquarter company in SA. For example, it exempts companies from

withholding dividends tax and tax on interest and royalties on income flowing

through them from foreign subsidiaries.

Value Added Tax (VAT)

The VAT system comprises of three types of supplies:

■ Standard-rated supplies – supplies of goods and services subject to the VAT

rate in force at the time of supply. With effect 1 April 2018 the VAT rate was

increased from 14% to 15%.

■ Exempt supplies – supplies of certain services not subject to VAT. Vendors

making exempt supplies are not entitled to input VAT credits.

■ Zero-rated supplies – supplies of certain goods or services subject to VAT at

zero percent. Vendors making zero-rated supplies are entitled to input VAT

credits.

35