Page 39 - Nexia SAB&T Business in South Africa Guide 2024

P. 39

Exclusions

The following are the main exclusions from CGT:

■ Primary residences with capital gains up to R2 million.

■ Personal use assets.

■ Retirement benefits.

■ Long-term assurance.

■ Small business assets with capital gains up to R1.8 million (applicable when

a person is over the age of 55 where the maximum market value of the small

business assets does not exceed R10 million).

■ Annual exclusion for natural persons: R40 000.

■ Annual exclusion on death for natural persons: R300 000.

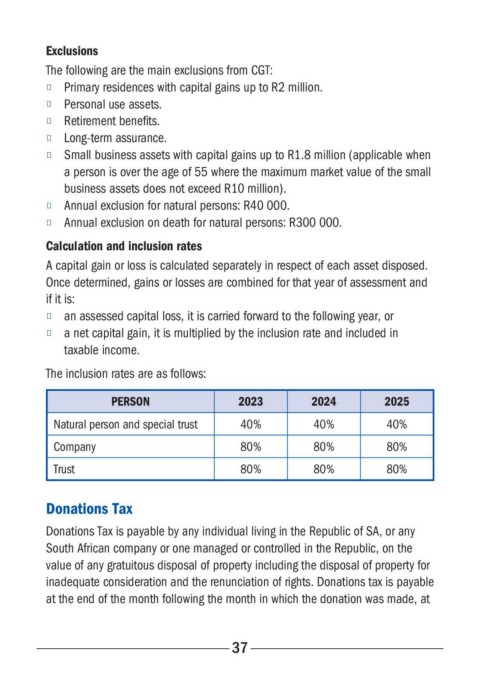

Calculation and inclusion rates

A capital gain or loss is calculated separately in respect of each asset disposed.

Once determined, gains or losses are combined for that year of assessment and

if it is:

■ an assessed capital loss, it is carried forward to the following year, or

■ a net capital gain, it is multiplied by the inclusion rate and included in

taxable income.

The inclusion rates are as follows:

PERSON 2023 2024 2025

Natural person and special trust 40% 40% 40%

Company 80% 80% 80%

Trust 80% 80% 80%

Donations Tax

Donations Tax is payable by any individual living in the Republic of SA, or any

South African company or one managed or controlled in the Republic, on the

value of any gratuitous disposal of property including the disposal of property for

inadequate consideration and the renunciation of rights. Donations tax is payable

at the end of the month following the month in which the donation was made, at

37