Page 4 - Nexia SAB&T Property & Tax Guide 2022

P. 4

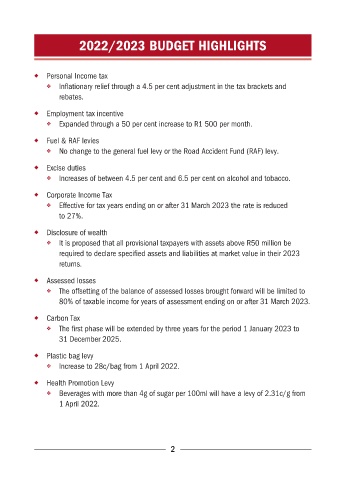

2022/2023 BUDGET HIGHLIGHTS

◆ Personal Income tax

❖ Inflationary relief through a 4.5 per cent adjustment in the tax brackets and

rebates.

◆ Employment tax incentive

❖ Expanded through a 50 per cent increase to R1 500 per month.

◆ Fuel & RAF levies

❖ No change to the general fuel levy or the Road Accident Fund (RAF) levy.

◆ Excise duties

❖ Increases of between 4.5 per cent and 6.5 per cent on alcohol and tobacco.

◆ Corporate Income Tax

❖ Effective for tax years ending on or after 31 March 2023 the rate is reduced

to 27%.

◆ Disclosure of wealth

❖ It is proposed that all provisional taxpayers with assets above R50 million be

required to declare specified assets and liabilities at market value in their 2023

returns.

◆ Assessed losses

❖ The offsetting of the balance of assessed losses brought forward will be limited to

80% of taxable income for years of assessment ending on or after 31 March 2023.

◆ Carbon Tax

❖ The first phase will be extended by three years for the period 1 January 2023 to

31 December 2025.

◆ Plastic bag levy

❖ Increase to 28c/bag from 1 April 2022.

◆ Health Promotion Levy

❖ Beverages with more than 4g of sugar per 100ml will have a levy of 2.31c/g from

1 April 2022.

2