Page 6 - Nexia SAB&T Property & Tax Guide 2022

P. 6

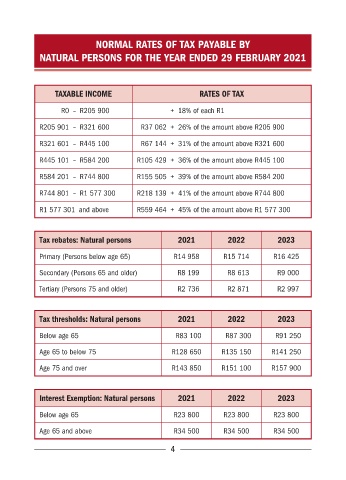

NORMAL RATES OF TAX PAYABLE BY

NATURAL PERSONS FOR THE YEAR ENDED 29 FEBRUARY 2021

TAXABLE INCOME RATES OF TAX

R0 – R205 900 + 18% of each R1

R205 901 – R321 600 R37 062 + 26% of the amount above R205 900

R321 601 – R445 100 R67 144 + 31% of the amount above R321 600

R445 101 – R584 200 R105 429 + 36% of the amount above R445 100

R584 201 – R744 800 R155 505 + 39% of the amount above R584 200

R744 801 – R1 577 300 R218 139 + 41% of the amount above R744 800

R1 577 301 and above R559 464 + 45% of the amount above R1 577 300

Tax rebates: Natural persons 2021 2022 2023

Primary (Persons below age 65) R14 958 R15 714 R16 425

Secondary (Persons 65 and older) R8 199 R8 613 R9 000

Tertiary (Persons 75 and older) R2 736 R2 871 R2 997

Tax thresholds: Natural persons 2021 2022 2023

Below age 65 R83 100 R87 300 R91 250

Age 65 to below 75 R128 650 R135 150 R141 250

Age 75 and over R143 850 R151 100 R157 900

Interest Exemption: Natural persons 2021 2022 2023

Below age 65 R23 800 R23 800 R23 800

Age 65 and above R34 500 R34 500 R34 500

4