Page 5 - Nexia SAB&T Property & Tax Guide 2022

P. 5

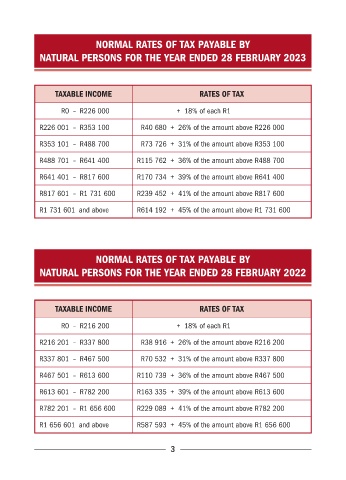

NORMAL RATES OF TAX PAYABLE BY

NATURAL PERSONS FOR THE YEAR ENDED 28 FEBRUARY 2023

TAXABLE INCOME RATES OF TAX

R0 – R226 000 + 18% of each R1

R226 001 – R353 100 R40 680 + 26% of the amount above R226 000

R353 101 – R488 700 R73 726 + 31% of the amount above R353 100

R488 701 – R641 400 R115 762 + 36% of the amount above R488 700

R641 401 – R817 600 R170 734 + 39% of the amount above R641 400

R817 601 – R1 731 600 R239 452 + 41% of the amount above R817 600

R1 731 601 and above R614 192 + 45% of the amount above R1 731 600

NORMAL RATES OF TAX PAYABLE BY

NATURAL PERSONS FOR THE YEAR ENDED 28 FEBRUARY 2022

TAXABLE INCOME RATES OF TAX

R0 – R216 200 + 18% of each R1

R216 201 – R337 800 R38 916 + 26% of the amount above R216 200

R337 801 – R467 500 R70 532 + 31% of the amount above R337 800

R467 501 – R613 600 R110 739 + 36% of the amount above R467 500

R613 601 – R782 200 R163 335 + 39% of the amount above R613 600

R782 201 – R1 656 600 R229 089 + 41% of the amount above R782 200

R1 656 601 and above R587 593 + 45% of the amount above R1 656 600

3