Page 15 - Nexia SAB&T Property and Tax Guide 2024

P. 15

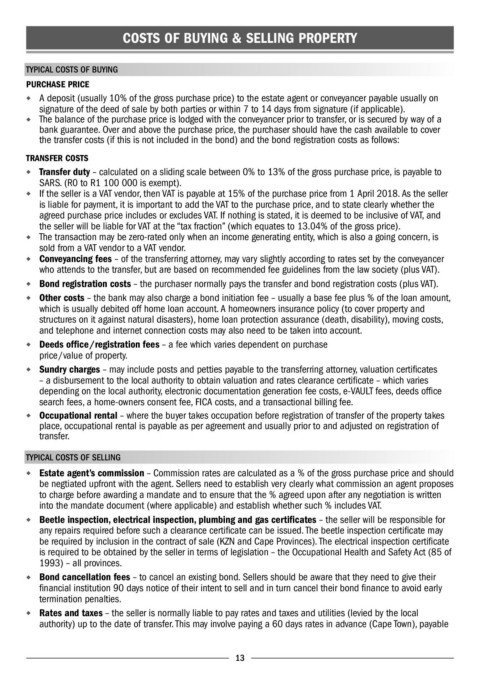

COSTS OF BUYING & SELLING PROPERTY

TYPICAL COSTS OF BUYING

PURCHASE PRICE

◆ A deposit (usually 10% of the gross purchase price) to the estate agent or conveyancer payable usually on

signature of the deed of sale by both parties or within 7 to 14 days from signature (if applicable).

◆ The balance of the purchase price is lodged with the conveyancer prior to transfer, or is secured by way of a

bank guarantee. Over and above the purchase price, the purchaser should have the cash available to cover

the transfer costs (if this is not included in the bond) and the bond registration costs as follows:

TRANSFER COSTS

◆ Transfer duty – calculated on a sliding scale between 0% to 13% of the gross purchase price, is payable to

SARS. (R0 to R1 100 000 is exempt).

◆ If the seller is a VAT vendor, then VAT is payable at 15% of the purchase price from 1 April 2018. As the seller

is liable for payment, it is important to add the VAT to the purchase price, and to state clearly whether the

agreed purchase price includes or excludes VAT. If nothing is stated, it is deemed to be inclusive of VAT, and

the seller will be liable for VAT at the “tax fraction” (which equates to 13.04% of the gross price).

◆ The transaction may be zero-rated only when an income generating entity, which is also a going concern, is

sold from a VAT vendor to a VAT vendor.

◆ Conveyancing fees – of the transferring attorney, may vary slightly according to rates set by the conveyancer

who attends to the transfer, but are based on recommended fee guidelines from the law society (plus VAT).

◆ Bond registration costs – the purchaser normally pays the transfer and bond registration costs (plus VAT).

◆ Other costs – the bank may also charge a bond initiation fee – usually a base fee plus % of the loan amount,

which is usually debited off home loan account. A homeowners insurance policy (to cover property and

structures on it against natural disasters), home loan protection assurance (death, disability), moving costs,

and telephone and internet connection costs may also need to be taken into account.

◆ Deeds office /registration fees – a fee which varies dependent on purchase

price /value of property.

◆ Sundry charges – may include posts and petties payable to the transferring attorney, valuation certificates

– a disbursement to the local authority to obtain valuation and rates clearance certificate – which varies

depending on the local authority, electronic documentation generation fee costs, e-VAULT fees, deeds office

search fees, a home-owners consent fee, FICA costs, and a transactional billing fee.

◆ Occupational rental – where the buyer takes occupation before registration of transfer of the property takes

place, occupational rental is payable as per agreement and usually prior to and adjusted on registration of

transfer.

TYPICAL COSTS OF SELLING

◆ Estate agent’s commission – Commission rates are calculated as a % of the gross purchase price and should

be negtiated upfront with the agent. Sellers need to establish very clearly what commission an agent proposes

to charge before awarding a mandate and to ensure that the % agreed upon after any negotiation is written

into the mandate document (where applicable) and establish whether such % includes VAT.

◆ Beetle inspection, electrical inspection, plumbing and gas certificates – the seller will be responsible for

any repairs required before such a clearance certificate can be issued. The beetle inspection certificate may

be required by inclusion in the contract of sale (KZN and Cape Provinces). The electrical inspection certificate

is required to be obtained by the seller in terms of legislation – the Occupational Health and Safety Act (85 of

1993) – all provinces.

◆ Bond cancellation fees – to cancel an existing bond. Sellers should be aware that they need to give their

financial institution 90 days notice of their intent to sell and in turn cancel their bond finance to avoid early

termination penalties.

◆ Rates and taxes – the seller is normally liable to pay rates and taxes and utilities (levied by the local

authority) up to the date of transfer. This may involve paying a 60 days rates in advance (Cape Town), payable

13