Page 18 - Nexia SAB&T Property and Tax Guide 2024

P. 18

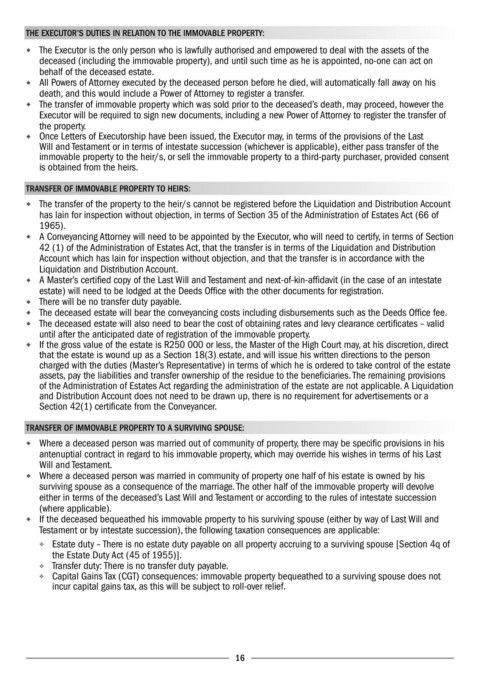

THE EXECUTOR’S DUTIES IN RELATION TO THE IMMOVABLE PROPERTY:

◆ The Executor is the only person who is lawfully authorised and empowered to deal with the assets of the

deceased (including the immovable property), and until such time as he is appointed, no-one can act on

behalf of the deceased estate.

◆ All Powers of Attorney executed by the deceased person before he died, will automatically fall away on his

death, and this would include a Power of Attorney to register a transfer.

◆ The transfer of immovable property which was sold prior to the deceased’s death, may proceed, however the

Executor will be required to sign new documents, including a new Power of Attorney to register the transfer of

the property.

◆ Once Letters of Executorship have been issued, the Executor may, in terms of the provisions of the Last

Will and Testament or in terms of intestate succession (whichever is applicable), either pass transfer of the

immovable property to the heir/s, or sell the immovable property to a third-party purchaser, provided consent

is obtained from the heirs.

TRANSFER OF IMMOVABLE PROPERTY TO HEIRS:

◆ The transfer of the property to the heir/s cannot be registered before the Liquidation and Distribution Account

has lain for inspection without objection, in terms of Section 35 of the Administration of Estates Act (66 of

1965).

◆ A Conveyancing Attorney will need to be appointed by the Executor, who will need to certify, in terms of Section

42 (1) of the Administration of Estates Act, that the transfer is in terms of the Liquidation and Distribution

Account which has lain for inspection without objection, and that the transfer is in accordance with the

Liquidation and Distribution Account.

◆ A Master’s certified copy of the Last Will and Testament and next-of-kin-affidavit (in the case of an intestate

estate) will need to be lodged at the Deeds Office with the other documents for registration.

◆ There will be no transfer duty payable.

◆ The deceased estate will bear the conveyancing costs including disbursements such as the Deeds Office fee.

◆ The deceased estate will also need to bear the cost of obtaining rates and levy clearance certificates – valid

until after the anticipated date of registration of the immovable property.

◆ If the gross value of the estate is R250 000 or less, the Master of the High Court may, at his discretion, direct

that the estate is wound up as a Section 18(3) estate, and will issue his written directions to the person

charged with the duties (Master’s Representative) in terms of which he is ordered to take control of the estate

assets, pay the liabilities and transfer ownership of the residue to the beneficiaries. The remaining provisions

of the Administration of Estates Act regarding the administration of the estate are not applicable. A Liquidation

and Distribution Account does not need to be drawn up, there is no requirement for advertisements or a

Section 42(1) certificate from the Conveyancer.

TRANSFER OF IMMOVABLE PROPERTY TO A SURVIVING SPOUSE:

◆ Where a deceased person was married out of community of property, there may be specific provisions in his

antenuptial contract in regard to his immovable property, which may override his wishes in terms of his Last

Will and Testament.

◆ Where a deceased person was married in community of property one half of his estate is owned by his

surviving spouse as a consequence of the marriage. The other half of the immovable property will devolve

either in terms of the deceased’s Last Will and Testament or according to the rules of intestate succession

(where applicable).

◆ If the deceased bequeathed his immovable property to his surviving spouse (either by way of Last Will and

Testament or by intestate succession), the following taxation consequences are applicable:

❖ Estate duty – There is no estate duty payable on all property accruing to a surviving spouse [Section 4q of

the Estate Duty Act (45 of 1955)].

❖ Transfer duty: There is no transfer duty payable.

❖ Capital Gains Tax (CGT) consequences: immovable property bequeathed to a surviving spouse does not

incur capital gains tax, as this will be subject to roll-over relief.

16