Page 16 - Nexia SAB&T Property and Tax Guide 2024

P. 16

to obtain clearance before registration of transfer (can vary from agreement to agreement). The seller may

then claim a refund from council for any amount overpaid, covering the period after registration of transfer.

◆ Electrical System Fence Certificate – Usually this will be provided for in sale agreements concluded after

1 October 2012, which in most cases, will require the seller to bear the cost of ensuring compliance with

specifications, together with the cost of obtaining the compliance certificate.

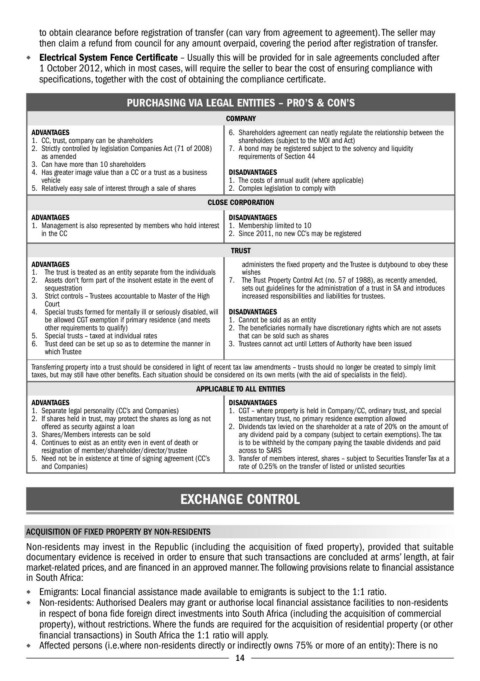

PURCHASING VIA LEGAL ENTITIES – PRO’S & CON’S

COMPANY

ADVANTAGES 6. Shareholders agreement can neatly regulate the relationship between the

1. CC, trust, company can be shareholders shareholders (subject to the MOI and Act)

2. Strictly controlled by legislation Companies Act (71 of 2008) 7. A bond may be registered subject to the solvency and liquidity

as amended requirements of Section 44

3. Can have more than 10 shareholders

4. Has greater image value than a CC or a trust as a business DISADVANTAGES

vehicle 1. The costs of annual audit (where applicable)

5. Relatively easy sale of interest through a sale of shares 2. Complex legislation to comply with

CLOSE CORPORATION

ADVANTAGES DISADVANTAGES

1. Management is also represented by members who hold interest 1. Membership limited to 10

in the CC 2. Since 2011, no new CC’s may be registered

TRUST

ADVANTAGES administers the fixed property and the Trustee is dutybound to obey these

1. The trust is treated as an entity separate from the individuals wishes

2. Assets don’t form part of the insolvent estate in the event of 7. The Trust Property Control Act (no. 57 of 1988), as recently amended,

sequestration sets out guidelines for the administration of a trust in SA and introduces

3. Strict controls – Trustees accountable to Master of the High increased responsibilities and liabilities for trustees.

Court

4. Special trusts formed for mentally ill or seriously disabled, will DISADVANTAGES

be allowed CGT exemption if primary residence (and meets 1. Cannot be sold as an entity

other requirements to qualify) 2. The beneficiaries normally have discretionary rights which are not assets

5. Special trusts – taxed at individual rates that can be sold such as shares

6. Trust deed can be set up so as to determine the manner in 3. Trustees cannot act until Letters of Authority have been issued

which Trustee

Transferring property into a trust should be considered in light of recent tax law amendments – trusts should no longer be created to simply limit

taxes, but may still have other benefits. Each situation should be considered on its own merits (with the aid of specialists in the field).

APPLICABLE TO ALL ENTITIES

ADVANTAGES DISADVANTAGES

1. Separate legal personality (CC’s and Companies) 1. CGT – where property is held in Company/CC, ordinary trust, and special

2. If shares held in trust, may protect the shares as long as not testamentary trust, no primary residence exemption allowed

offered as security against a loan 2. Dividends tax levied on the shareholder at a rate of 20% on the amount of

3. Shares/Members interests can be sold any dividend paid by a company (subject to certain exemptions). The tax

4. Continues to exist as an entity even in event of death or is to be withheld by the company paying the taxable dividends and paid

resignation of member/shareholder/director/trustee across to SARS

5. Need not be in existence at time of signing agreement (CC’s 3. Transfer of members interest, shares – subject to Securities Transfer Tax at a

and Companies) rate of 0.25% on the transfer of listed or unlisted securities

EXCHANGE CONTROL

ACQUISITION OF FIXED PROPERTY BY NON-RESIDENTS

Non-residents may invest in the Republic (including the acquisition of fixed property), provided that suitable

documentary evidence is received in order to ensure that such transactions are concluded at arms’ length, at fair

market-related prices, and are financed in an approved manner. The following provisions relate to financial assistance

in South Africa:

◆ Emigrants: Local financial assistance made available to emigrants is subject to the 1:1 ratio.

◆ Non-residents: Authorised Dealers may grant or authorise local financial assistance facilities to non-residents

in respect of bona fide foreign direct investments into South Africa (including the acquisition of commercial

property), without restrictions. Where the funds are required for the acquisition of residential property (or other

financial transactions) in South Africa the 1:1 ratio will apply.

◆ Affected persons (i.e.where non-residents directly or indirectly owns 75% or more of an entity): There is no

14