Page 20 - Nexia SAB&T Property and Tax Guide 2024

P. 20

◆ Under most circumstances, although capital gains tax may be paid at the death of the deceased (in terms

of the deceased person’s final income tax return, as described above), no further capital gains tax will be

payable when an heir or legatee receives the property from the deceased estate.

◆ Capital gains tax will only arise again when the heir disposes of the property at a later stage, where the

calculation will reflect the proceeds as equal to the selling price of the property, and the base cost equal to

the market value of the property at the date of death of the deceased.

TRANSFER OF IMMOVABLE PROPERTY TO THE SURVIVING SPOUSE AND CGT

◆ All assets that pass to a surviving spouse (either by way of a Last Will and Testament, or by intestate

succession, or by way of a redistribution agreement between the heirs/legatees) are subject to “roll over”

CGT relief.

◆ This means that capital gains tax is postponed until the surviving spouse disposes of the assets during his

or her lifetime or at death- the capital gain is then determined from the date of acquisition by the first dying

spouse and the base cost at such disposal is the base cost as incurred by the first dying spouse.

◆ The implication is that the original base cost is rolled over to the surviving spouse, and when he or she finally

disposes of the property, capital gains tax will be levied on the difference between the proceeds and the

original base cost.

TRUSTS

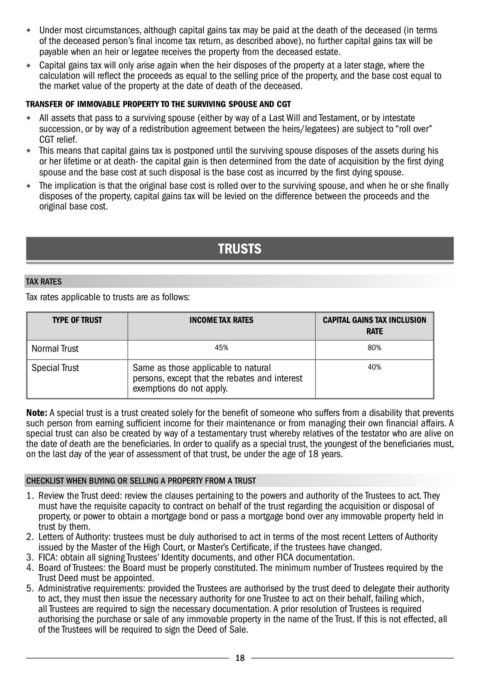

TAX RATES

Tax rates applicable to trusts are as follows:

TYPE OF TRUST INCOME TAX RATES CAPITAL GAINS TAX INCLUSION

RATE

Normal Trust 45% 80%

Special Trust Same as those applicable to natural 40%

persons, except that the rebates and interest

exemptions do not apply.

Note: A special trust is a trust created solely for the benefit of someone who suffers from a disability that prevents

such person from earning sufficient income for their maintenance or from managing their own financial affairs. A

special trust can also be created by way of a testamentary trust whereby relatives of the testator who are alive on

the date of death are the beneficiaries. In order to qualify as a special trust, the youngest of the beneficiaries must,

on the last day of the year of assessment of that trust, be under the age of 18 years.

CHECKLIST WHEN BUYING OR SELLING A PROPERTY FROM A TRUST

1. Review the Trust deed: review the clauses pertaining to the powers and authority of the Trustees to act. They

must have the requisite capacity to contract on behalf of the trust regarding the acquisition or disposal of

property, or power to obtain a mortgage bond or pass a mortgage bond over any immovable property held in

trust by them.

2. Letters of Authority: trustees must be duly authorised to act in terms of the most recent Letters of Authority

issued by the Master of the High Court, or Master’s Certificate, if the trustees have changed.

3. FICA: obtain all signing Trustees’ Identity documents, and other FICA documentation.

4. Board of Trustees: the Board must be properly constituted. The minimum number of Trustees required by the

Trust Deed must be appointed.

5. Administrative requirements: provided the Trustees are authorised by the trust deed to delegate their authority

to act, they must then issue the necessary authority for one Trustee to act on their behalf, failing which,

all Trustees are required to sign the necessary documentation. A prior resolution of Trustees is required

authorising the purchase or sale of any immovable property in the name of the Trust. If this is not effected, all

of the Trustees will be required to sign the Deed of Sale.

18