Page 22 - Nexia SAB&T Property and Tax Guide 2024

P. 22

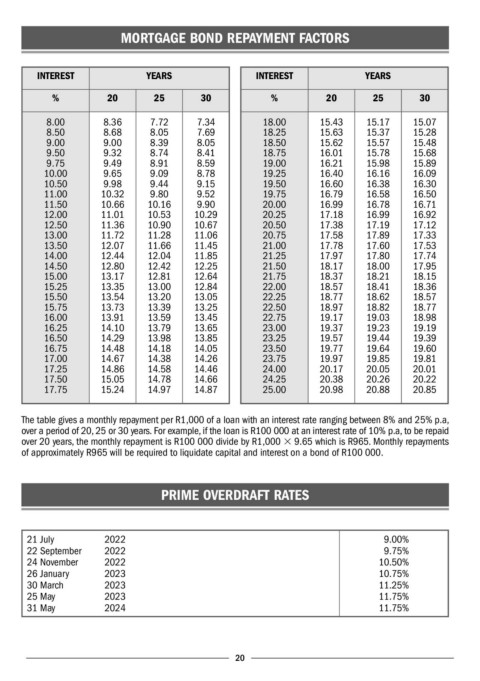

MORTGAGE BOND REPAYMENT FACTORS

INTEREST YEARS INTEREST YEARS

% 20 25 30 % 20 25 30

8.00 8.36 7.72 7.34 18.00 15.43 15.17 15.07

8.50 8.68 8.05 7.69 18.25 15.63 15.37 15.28

9.00 9.00 8.39 8.05 18.50 15.62 15.57 15.48

9.50 9.32 8.74 8.41 18.75 16.01 15.78 15.68

9.75 9.49 8.91 8.59 19.00 16.21 15.98 15.89

10.00 9.65 9.09 8.78 19.25 16.40 16.16 16.09

10.50 9.98 9.44 9.15 19.50 16.60 16.38 16.30

11.00 10.32 9.80 9.52 19.75 16.79 16.58 16.50

11.50 10.66 10.16 9.90 20.00 16.99 16.78 16.71

12.00 11.01 10.53 10.29 20.25 17.18 16.99 16.92

12.50 11.36 10.90 10.67 20.50 17.38 17.19 17.12

13.00 11.72 11.28 11.06 20.75 17.58 17.89 17.33

13.50 12.07 11.66 11.45 21.00 17.78 17.60 17.53

14.00 12.44 12.04 11.85 21.25 17.97 17.80 17.74

14.50 12.80 12.42 12.25 21.50 18.17 18.00 17.95

15.00 13.17 12.81 12.64 21.75 18.37 18.21 18.15

15.25 13.35 13.00 12.84 22.00 18.57 18.41 18.36

15.50 13.54 13.20 13.05 22.25 18.77 18.62 18.57

15.75 13.73 13.39 13.25 22.50 18.97 18.82 18.77

16.00 13.91 13.59 13.45 22.75 19.17 19.03 18.98

16.25 14.10 13.79 13.65 23.00 19.37 19.23 19.19

16.50 14.29 13.98 13.85 23.25 19.57 19.44 19.39

16.75 14.48 14.18 14.05 23.50 19.77 19.64 19.60

17.00 14.67 14.38 14.26 23.75 19.97 19.85 19.81

17.25 14.86 14.58 14.46 24.00 20.17 20.05 20.01

17.50 15.05 14.78 14.66 24.25 20.38 20.26 20.22

17.75 15.24 14.97 14.87 25.00 20.98 20.88 20.85

The table gives a monthly repayment per R1,000 of a loan with an interest rate ranging between 8% and 25% p.a,

over a period of 20, 25 or 30 years. For example, if the loan is R100 000 at an interest rate of 10% p.a, to be repaid

over 20 years, the monthly repayment is R100 000 divide by R1,000 × 9.65 which is R965. Monthly repayments

of approximately R965 will be required to liquidate capital and interest on a bond of R100 000.

PRIME OVERDRAFT RATES

21 July 2022 9.00%

22 September 2022 9.75%

24 November 2022 10.50%

26 January 2023 10.75%

30 March 2023 11.25%

25 May 2023 11.75%

31 May 2024 11.75%

20