Page 21 - Nexia SAB&T Property and Tax Guide 2024

P. 21

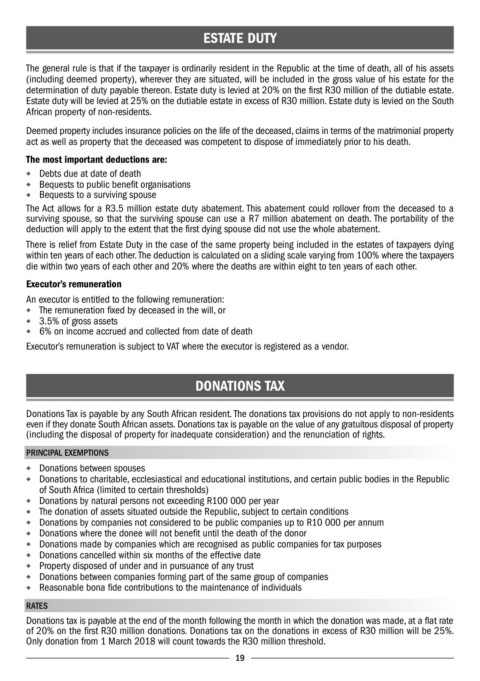

ESTATE DUTY

The general rule is that if the taxpayer is ordinarily resident in the Republic at the time of death, all of his assets

(including deemed property), wherever they are situated, will be included in the gross value of his estate for the

determination of duty payable thereon. Estate duty is levied at 20% on the first R30 million of the dutiable estate.

Estate duty will be levied at 25% on the dutiable estate in excess of R30 million. Estate duty is levied on the South

African property of non-residents.

Deemed property includes insurance policies on the life of the deceased, claims in terms of the matrimonial property

act as well as property that the deceased was competent to dispose of immediately prior to his death.

The most important deductions are:

◆ Debts due at date of death

◆ Bequests to public benefit organisations

◆ Bequests to a surviving spouse

The Act allows for a R3.5 million estate duty abatement. This abatement could rollover from the deceased to a

surviving spouse, so that the surviving spouse can use a R7 million abatement on death. The portability of the

deduction will apply to the extent that the first dying spouse did not use the whole abatement.

There is relief from Estate Duty in the case of the same property being included in the estates of taxpayers dying

within ten years of each other. The deduction is calculated on a sliding scale varying from 100% where the taxpayers

die within two years of each other and 20% where the deaths are within eight to ten years of each other.

Executor’s remuneration

An executor is entitled to the following remuneration:

◆ The remuneration fixed by deceased in the will, or

◆ 3.5% of gross assets

◆ 6% on income accrued and collected from date of death

Executor’s remuneration is subject to VAT where the executor is registered as a vendor.

DONATIONS TAX

Donations Tax is payable by any South African resident. The donations tax provisions do not apply to non-residents

even if they donate South African assets. Donations tax is payable on the value of any gratuitous disposal of property

(including the disposal of property for inadequate consideration) and the renunciation of rights.

PRINCIPAL EXEMPTIONS

◆ Donations between spouses

◆ Donations to charitable, ecclesiastical and educational institutions, and certain public bodies in the Republic

of South Africa (limited to certain thresholds)

◆ Donations by natural persons not exceeding R100 000 per year

◆ The donation of assets situated outside the Republic, subject to certain conditions

◆ Donations by companies not considered to be public companies up to R10 000 per annum

◆ Donations where the donee will not benefit until the death of the donor

◆ Donations made by companies which are recognised as public companies for tax purposes

◆ Donations cancelled within six months of the effective date

◆ Property disposed of under and in pursuance of any trust

◆ Donations between companies forming part of the same group of companies

◆ Reasonable bona fide contributions to the maintenance of individuals

RATES

Donations tax is payable at the end of the month following the month in which the donation was made, at a flat rate

of 20% on the first R30 million donations. Donations tax on the donations in excess of R30 million will be 25%.

Only donation from 1 March 2018 will count towards the R30 million threshold.

19