Page 4 - Nexia SAB&T Property and Tax Guide 2025

P. 4

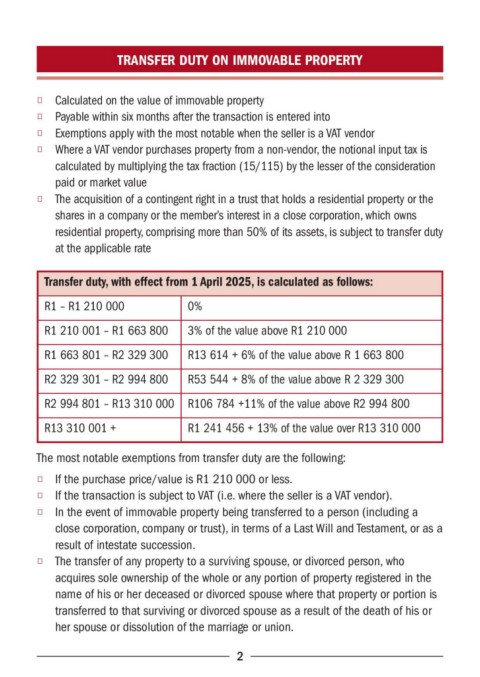

TRANSFER DUTY ON IMMOVABLE PROPERTY

◆ Calculated on the value of immovable property

◆ Payable within six months after the transaction is entered into

◆ Exemptions apply with the most notable when the seller is a VAT vendor

◆ Where a VAT vendor purchases property from a non-vendor, the notional input tax is

calculated by multiplying the tax fraction (15/115) by the lesser of the consideration

paid or market value

◆ The acquisition of a contingent right in a trust that holds a residential property or the

shares in a company or the member’s interest in a close corporation, which owns

residential property, comprising more than 50% of its assets, is subject to transfer duty

at the applicable rate

Transfer duty, with effect from 1 April 2025, is calculated as follows:

R1 – R1 210 000 0%

R1 210 001 – R1 663 800 3% of the value above R1 210 000

R1 663 801 – R2 329 300 R13 614 + 6% of the value above R 1 663 800

R2 329 301 – R2 994 800 R53 544 + 8% of the value above R 2 329 300

R2 994 801 – R13 310 000 R106 784 +11% of the value above R2 994 800

R13 310 001 + R1 241 456 + 13% of the value over R13 310 000

The most notable exemptions from transfer duty are the following:

◆ If the purchase price/value is R1 210 000 or less.

◆ If the transaction is subject to VAT (i.e. where the seller is a VAT vendor).

◆ In the event of immovable property being transferred to a person (including a

close corporation, company or trust), in terms of a Last Will and Testament, or as a

result of intestate succession.

◆ The transfer of any property to a surviving spouse, or divorced person, who

acquires sole ownership of the whole or any portion of property registered in the

name of his or her deceased or divorced spouse where that property or portion is

transferred to that surviving or divorced spouse as a result of the death of his or

her spouse or dissolution of the marriage or union.

2