Page 8 - Nexia SAB&T Property and Tax Guide 2025

P. 8

The valuation date value is calculated as follows:

◆ The market value on 1/10/2001 as determined by a valuation; or

◆ 20% of the proceeds after deducting the allowable capital expenditure incurred

after valuation date; or

◆ The time apportioned base cost, as determined by a formula.

Allowable capital expenditure includes the following:

◆ The cost of acquiring, creating or improving the asset (excluding any borrowing

costs).

◆ The cost for valuation of the property for CGT purposes.

◆ Cost incurred in respect of disposal of the property (including sales commission,

advertising, valuation costs, accounting and legal costs, removal cost etc.).

A capital gain or loss is calculated separately in respect of each asset disposed. Once

deter mined, gains or losses are combined for that year of assessment and if it is:

◆ An assessed capital loss, it is carried forward to the following year; or

◆ A net capital gain, it is multiplied by the inclusion rate and included in taxable

income.

◆ Annual exclusion of R40 000 capital gain or capital loss is granted to individuals

and special trusts.

◆ Instead of the annual exclusion, the exclusion granted to individuals is R300 000

for the year of death.

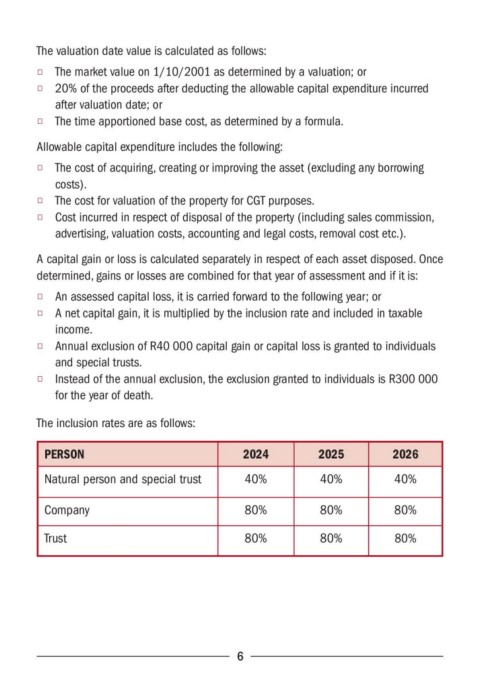

The inclusion rates are as follows:

PERSON 2024 2025 2026

Natural person and special trust 40% 40% 40%

Company 80% 80% 80%

Trust 80% 80% 80%

6