Page 6 - Nexia SAB&T Property and Tax Guide 2025

P. 6

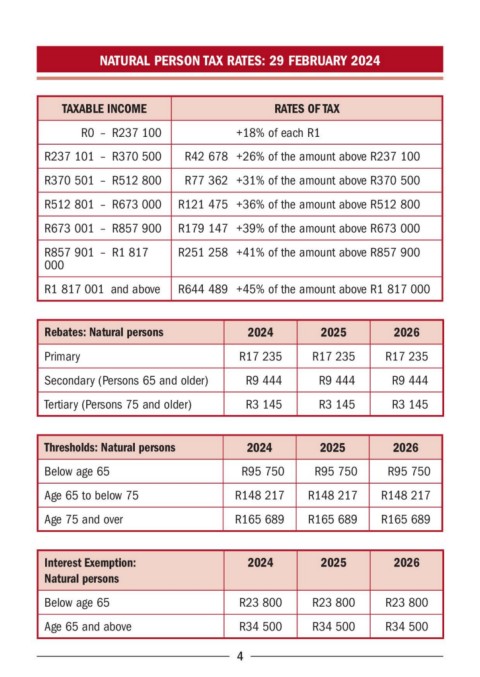

NATURAL PERSON TAX RATES: 29 FEBRUARY 2024

TAXABLE INCOME RATES OF TAX

R0 – R237 100 +18% of each R1

R237 101 – R370 500 R42 678 +26% of the amount above R237 100

R370 501 – R512 800 R77 362 +31% of the amount above R370 500

R512 801 – R673 000 R121 475 +36% of the amount above R512 800

R673 001 – R857 900 R179 147 +39% of the amount above R673 000

R857 901 – R1 817 R251 258 +41% of the amount above R857 900

000

R1 817 001 and above R644 489 +45% of the amount above R1 817 000

Rebates: Natural persons 2024 2025 2026

Primary R17 235 R17 235 R17 235

Secondary (Persons 65 and older) R9 444 R9 444 R9 444

Tertiary (Persons 75 and older) R3 145 R3 145 R3 145

Thresholds: Natural persons 2024 2025 2026

Below age 65 R95 750 R95 750 R95 750

Age 65 to below 75 R148 217 R148 217 R148 217

Age 75 and over R165 689 R165 689 R165 689

Interest Exemption: 2024 2025 2026

Natural persons

Below age 65 R23 800 R23 800 R23 800

Age 65 and above R34 500 R34 500 R34 500

4