Page 5 - Nexia SAB&T Property and Tax Guide 2025

P. 5

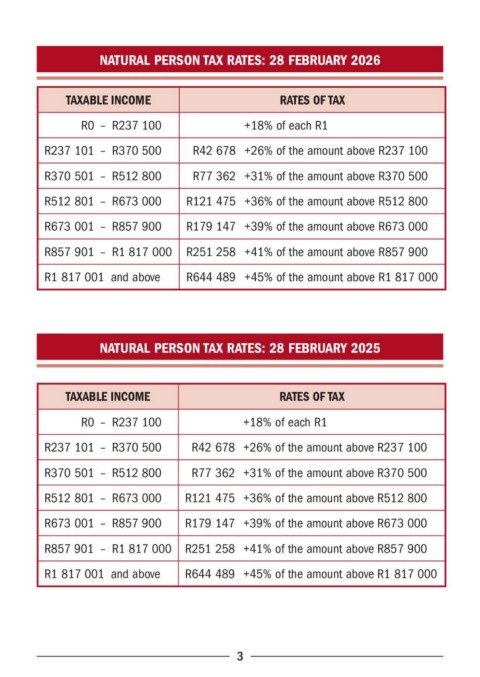

NATURAL PERSON TAX RATES: 28 FEBRUARY 2026

TAXABLE INCOME RATES OF TAX

R0 – R237 100 +18% of each R1

R237 101 – R370 500 R42 678 +26% of the amount above R237 100

R370 501 – R512 800 R77 362 +31% of the amount above R370 500

R512 801 – R673 000 R121 475 +36% of the amount above R512 800

R673 001 – R857 900 R179 147 +39% of the amount above R673 000

R857 901 – R1 817 000 R251 258 +41% of the amount above R857 900

R1 817 001 and above R644 489 +45% of the amount above R1 817 000

NATURAL PERSON TAX RATES: 28 FEBRUARY 2025

TAXABLE INCOME RATES OF TAX

R0 – R237 100 +18% of each R1

R237 101 – R370 500 R42 678 +26% of the amount above R237 100

R370 501 – R512 800 R77 362 +31% of the amount above R370 500

R512 801 – R673 000 R121 475 +36% of the amount above R512 800

R673 001 – R857 900 R179 147 +39% of the amount above R673 000

R857 901 – R1 817 000 R251 258 +41% of the amount above R857 900

R1 817 001 and above R644 489 +45% of the amount above R1 817 000

3